(A Deep Dive by CFP® Taresh Bhatia)

There are some questions I hear repeatedly these days:

“Taresh Sir, are my take-home earnings going to fall because of the new PF rules?”

“Is the gratuity rule changing for everyone?”

“Why is the government redefining the salary structure?”

Whenever any policy changes in India, our instinct is to panic first and understand later.

But after spending more than two decades guiding working professionals, couples and entrepreneurs through their financial journeys, I have learned something simple:

Policy changes rarely destroy your financial life.

But your lack of preparation can.

The new Labour Code and its proposed changes to PF and Gratuity fall exactly in this category.

There is anxiety, confusion, half-knowledge and tons of WhatsApp forwards — but very little structured understanding.

So today, I want to break this down for you in my usual “Taresh Writes” way —

a mix of storytelling, plain-English explanation, financial-planning depth and actionable clarity.

This is not just a legal update.

This is a financial-life moment — one that can either strengthen your future or surprise you later.

Let’s begin.

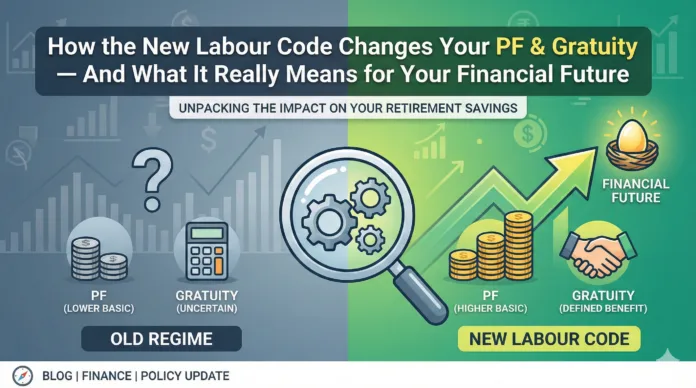

1. Why the Labour Code Is a Big Deal — Even If You Don’t Realise It Yet

When the government brings four labour laws into one consolidated Labour Code, the goal is simple:

reduce complexity, increase transparency and ensure long-term social security for workers.

But for India’s big salaried population, these are not “policy points.”

These changes directly influence:

- your monthly take-home salary

- your employer contribution

- your retirement corpus

- your gratuity entitlement

- your financial planning roadmap

- your job-switch decisions

One of my clients told me recently,

“Sir, मुझे तो समझ ही नहीं आ रहा कि असल में क्या बदला है! Clients explain करते हैं, HR अलग बोलता है, news अलग।”

This confusion is natural. Because the changes don’t just tweak the numbers —

they change the philosophy of compensation.

At the heart of these changes lies one simple shift:

The definition of “Wages” — which now must be at least 50% of your CTC.

This single change will ripple through your entire financial ecosystem.

2. Wages Must Be 50% of CTC — The Foundation of All New Calculations

Earlier, companies had the flexibility to manipulate salary structures to reduce their PF/Gratuity liability.

Someone with a ₹20 lakh CTC might have had a basic salary of only ₹5 lakh.

PF was calculated on that low basic.

Gratuity was calculated on that low basic.

Companies looked good.

Employees enjoyed a higher take-home.

But long-term security?

Compromised.

The new Labour Code fixes this loophole:

Basic + DA + Retaining Allowance must be at least 50% of your total CTC.

This means your PF contributions may increase.

Your gratuity may increase.

Your employer’s liability increases too.

Is this good or bad?

Let me explain with a real story.

3. The Gaurav Story — A Simple Example of Misplaced Panic

Gaurav, 38, works in a Gurgaon-based MNC.

He came to me worried:

“Sir, I heard my PF contribution will increase.

This means less take-home.

I already have EMIs, school fees — how will this work?”

I let him finish.

Then I asked him one question:

“When you turn 60, what will matter more — a few thousand rupees more today or a few lakhs more in your retirement corpus?”

There was silence.

I have coached thousands of Indian families.

Here’s the truth we don’t like to hear:

We overestimate the importance of today’s take-home

and underestimate the power of long-term compounding.

Under the new Labour Code:

- If PF increases, your retirement safety increases.

- If gratuity increases, your long-term benefits increase.

- If take-home reduces slightly, your future becomes more stable.

Gaurav understood it.

And I want you to understand it too.

4. PF Contribution Will Rise — But So Will Your Wealth

Let’s take the same example.

If your company currently keeps

Basic = 30% of CTC,

they may now need to make it

Basic = 50% of CTC.

This increases your PF base.

The ideal way to look at this is:

**Short-term discomfort

for long-term strength.**

Let’s calculate.

Suppose your PF contribution increases by ₹3,000 per month.

Your employer also adds ₹3,000.

Total = ₹6,000 monthly addition.

For 25 years, at 8% EPF interest:

👉 ₹6,000/month becomes ₹49 lakh.

Yes, almost ₹50 lakh.

This is why I tell employees:

**Your PF is not salary reduction.

Your PF is forced wealth creation.**

If you have ever checked your EPFO passbook and seen a balance that surprised you,

remember — it is PF that quietly changed your life.

With the new rules, that quiet blessing becomes bigger.

5. Gratuity Reform — A Game Changer for Modern Employment

Earlier, gratuity was a benefit reserved for those who completed 5 full years in a company.

But today’s job landscape looks nothing like the 1980s:

- shorter job tenures

- more contract roles

- fixed-term employment

- gig economy

- flexible workforces

The Labour Code acknowledges this new reality.

Fixed-term employees may now be eligible for gratuity even if they haven’t completed five years.

This is a massive win for young professionals.

I remember helping a client, a young graphic designer, who worked 3-year projects but never received gratuity. She would say,

“Sir, मेरे roommates दो–दो companies बदल चुके हैं।

हम लोग long-term gratuity benefit कभी touch ही नहीं कर पाते।”

Now, she may not have to wait five years.

Long-term benefits finally enter the modern work era.

6. Employers Must Restructure Their CTC — Transparency Increases

This is one of the most underrated outcomes.

Employers can no longer:

- artificially inflate allowance components

- suppress Basic

- reduce PF and gratuity payouts indirectly

Now the salary structure must be fair.

For years, employees lived under the illusion of “big CTC, small in-hand value.”

With the new rules:

- your CTC will reflect reality

- your benefits become predictable

- your retirement planning becomes clearer

Pure transparency.

Long overdue.

7. The Employee’s Dilemma — Take-Home Salary vs. Financial Security

During my workshops, when I explain PF/gratuity benefits, someone always asks:

“Sir, अगर मुझे ही अपनी salary save करनी है, I can invest in mutual funds — why forced PF?”

My counter is simple.

Do you actually invest the same amount every month with discipline?

Most don’t.

Most can’t.

Most won’t.

PF is not a tax.

PF is not a burden.

PF is a protection mechanism for your future self.

Even for top professionals earning ₹50–₹70 lakh a year, I see one repeated pattern:

Lifestyle grows faster than savings.

PF stops that leakage.

Gratuity supports your future stability.

The Labour Code enforces financial discipline.

As a CERTIFIED FINANCIAL PLANNER®,

I welcome this.

8. What You Must Do Now — Your Personal Action Plan

This is the part most employees ignore.

Policies change.

But if you don’t change anything, benefits remain unleveraged.

Here is what I want every employee to do today:

Step 1: Re-evaluate your CTC structure

Ask HR for:

- New wage breakup

- PF calculation basis

- Gratuity impact

- Any take-home reduction

- Revised employer contribution

Understand the numbers.

Take charge.

Step 2: Recalculate your retirement plan

If PF has increased, you must:

- update your financial plan

- adjust your SIPs and equity exposure

- recheck your retirement corpus target

Many people reduce their SIP just because PF increases.

Huge mistake.

Let PF be the safety net.

Let equity be the growth engine.

Step 3: Consolidate all your PF accounts

The biggest tragedy in India is:

Crores of rupees lie unclaimed in old PF accounts.

Under the new rules, transfers are seamless via UAN.

Spend 20 minutes today and connect everything.

Step 4: Prepare for lower take-home for a few months

Yes, this may happen.

And that’s okay.

Long-term wealth is built by these small, “invisible sacrifices.”

Step 5: Don’t look at the Labour Code emotionally — look at it strategically

Policies are not meant to make us comfortable.

They’re meant to make us secure.

9. How This Will Shape India’s Future Workforce

I genuinely believe this:

The Labour Code may quietly become one of the biggest financial-improvement initiatives for India’s middle-class workforce.

Why?

Because:

- retirement savings will rise

- financial discipline will rise

- job benefits become fairer

- gig and contract workers gain long-term protection

- CTC transparency improves

- social security widens

Think 25 years ahead.

Millions of Indians will retire with significantly larger PF and gratuity sums.

This is nation-building.

This is the silent foundation of a financially secure India.

10. My Final Word — Don’t Fear the Change. Prepare for It.

In my years as a financial planner, I have seen two kinds of people:

1. Those who resist change and stay confused.

2. Those who understand change and get ahead.

I want you to be in the second category.

The Labour Code is not perfect.

No policy ever is.

But if you look at it through the lens of long-term financial planning,

it is a powerful structural shift.

It strengthens your future.

It protects your retirement.

It reduces systemic manipulation.

It makes compensation transparent.

It promotes savings discipline.

As I often tell my clients:

**“Your salary helps you live today.

Your PF and gratuity help you live tomorrow.”**

This is the moment to embrace the shift —

with clarity, awareness and smart financial planning.

If you want, I can create:

Disclaimer: The views expressed are for educational purposes only and do not constitute financial, investment, tax, or legal advice. Please consult qualified professionals before making decisions. Mutual fund investments are subject to market risks.

👉 Full Disclaimer | Disclosures | Terms of Use

| 👉Join my FAN page at: | facebook.com/CFPTareshBhatia |

| 👉Follow on Facebook: | facebook.com/TareshBhatiaCFPro |

| 👉Follow me on Instagram: | instagram.com/tareshbhatiacfp |

| 👉Follow me on Threads: | threads.net/@tareshbhatiacfp |

| 👉Follow me on Twitter: | twitter.com/tareshbhatiacfp |

| 👉Follow me on LinkedIn: | linkedin.com/in/tareshbhatiacfp |

| 👉Visit Website: | tareshbhatia.com |

| 👉Read Blog: | blog.tareshbhatia.com |

| 👉Buy my Book: | pages.razorpay.com/BookTRP |

| 👉Join me on Telegram: | t.me/+v0ewUJQU0wowN2Jl |

| 👉YouTube Channel: | youtube.com/@Taresh-Bhatia |

| 👉Subscribe: | tinyurl.com/SubscTB |

| 👉Join my Academy: | therichnessacademy.com |

| 👉Complimentary Session-Limited Offer: | learn.therichnessacademy.com/web/checkout/686f9d1203ac6c6374689439 |

| 👉WhatsApp message directly: | wa.me/919810127906 |

| 👉Get Ebook: | tinyurl.com/TenEbook |

The author of this article, Taresh Bhatia, is a Certified Financial Planner® and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2025: All Rights Reserved. Taresh Bhatia. Certified Financial Planner®

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here