Introduction

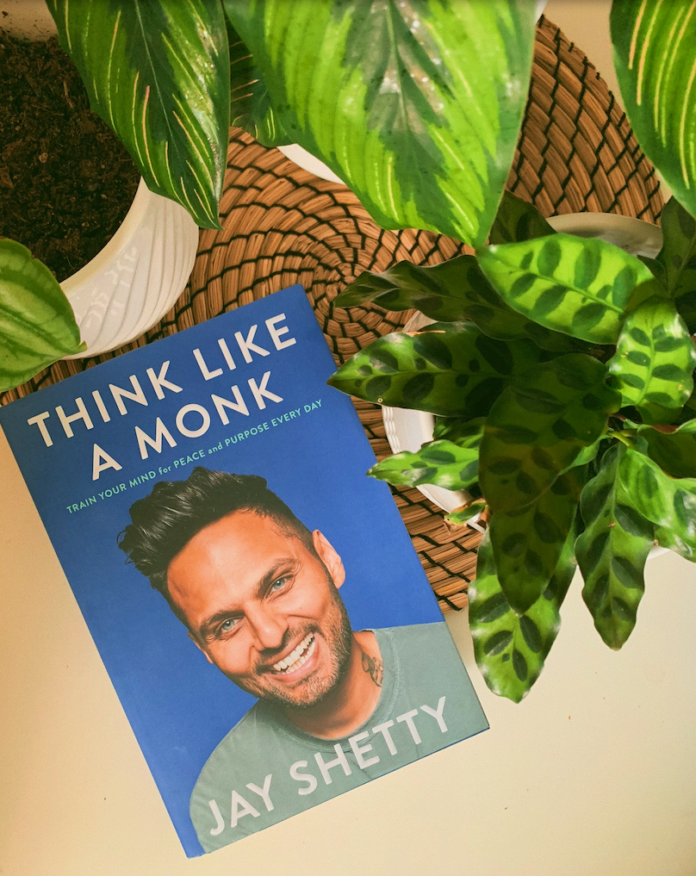

In my journey as a CERTIFIED financial-planner-gurgaon/" target="_blank" rel="nofollow">FINANCIAL PLANNER and Coach at the Richness Academy, I’ve found that financial freedom and personal fulfillment are deeply interconnected. Helping my clients—working senior professionals, entrepreneurs, young married couples, retirees, single mothers, and divorced women—achieve their financial goals is only part of the equation. The other part involves fostering a mindset that embraces richness and wisdom in all areas of life. Jay Shetty’s book “Think Like a Monk” offers profound insights into how we can cultivate such a mindset.

Shetty, drawing from his experiences as a monk and combining them with modern psychology, provides ten key lessons that can transform our approach to life. Let’s explore these lessons and how they can be applied in the context of our financial and personal goals.

Purpose and Passion

Understanding Purpose and Passion

Jay Shetty underscores the necessity of discovering one’s purpose and aligning it with passion. This alignment not only brings fulfillment but also drives us to pursue work and activities that make a positive impact. For my clients, understanding their financial purpose—whether it’s securing their family’s future, starting a business, or achieving a comfortable retirement—is paramount.

Applying It in Our Lives

To align with your financial purpose, start by identifying what truly matters to you. Reflect on your passions and how they can be integrated into your financial goals. For instance, if you’re passionate about education, consider investing in educational ventures or saving for your children’s higher education. This purposeful approach ensures that your financial plans are not just about accumulating wealth but about creating a meaningful impact.

Mindfulness and Meditation

The Power of Mindfulness

Shetty teaches the transformative power of mindfulness and meditation. These practices help cultivate inner peace, reduce stress, and enhance focus—qualities that are invaluable in financial planning and decision-making.

Practical Techniques

Incorporate daily mindfulness practices into your routine. Simple techniques like focused breathing or guided meditations can significantly improve your mental clarity and decision-making capabilities. When managing your finances, practice mindfulness by being present and fully aware of your spending habits and investment choices. This awareness helps in making thoughtful and deliberate financial decisions.

Gratitude and Positivity

Cultivating Gratitude

Gratitude has a profound impact on our perspective and overall happiness. Shetty explains how a gratitude practice can shift our mindset from scarcity to abundance, which is crucial in achieving financial freedom.

Daily Gratitude Practice

Start a daily gratitude journal. Each day, write down three things you are grateful for, especially related to your financial journey. This practice not only boosts positivity but also reinforces a mindset of abundance. For instance, being grateful for your job or a successful investment can enhance your motivation and satisfaction.

Also read: Unlocking the Secrets of “The Alchemist” by Paulo Coelho: A Personal Journey to Self-Discovery

Overcoming Negativity

Managing Negativity

Negativity can be a significant barrier to achieving financial goals. Shetty discusses strategies to overcome negative thoughts and cultivate resilience.

Resilience Building

To manage negativity, practice reframing negative thoughts into positive ones. For example, instead of dwelling on financial setbacks, focus on what you can learn from them and how you can improve. Building resilience involves viewing challenges as opportunities for growth, which can be applied to overcoming financial hurdles.

Relationships and Connection

Nurturing Relationships

Meaningful relationships are crucial for personal and financial well-being. Shetty emphasizes the importance of fostering connections and building strong, supportive relationships.

Building Financial Support Networks

Surround yourself with a supportive financial community. This could include family, friends, or a financial planner who understands your goals. Strong relationships provide emotional support and practical advice, helping you stay committed to your financial plans.

Service and Contribution

The Joy of Service

Shetty highlights the importance of service and making a positive contribution to society. This not only brings joy but also creates a sense of purpose.

Incorporating Service into Financial Plans

Consider how your financial goals can contribute to society. This could involve charitable donations, investing in social enterprises, or volunteering your time and skills. Serving others through your financial decisions enhances your sense of fulfillment and aligns your wealth with your values.

Inner Growth and Self-Discovery

The Journey of Self-Discovery

Understanding oneself and unlocking one’s full potential is a central theme in Shetty’s teachings. This journey of inner growth is essential for achieving both personal and financial success.

Self-Reflection Practices

Engage in regular self-reflection to understand your financial behaviors and motivations. Journaling about your financial goals, fears, and achievements can provide insights into your financial habits and help you make more informed decisions.

Living with Intention

Intentional Living

Living intentionally means making conscious choices that align with your values and goals. Shetty advocates for setting clear intentions in all aspects of life.

Setting Financial Intentions

Define your financial intentions clearly. Whether it’s saving for a house, planning for retirement, or reducing debt, setting specific intentions helps guide your financial decisions. Review your financial goals regularly and ensure that your actions align with these intentions.

Embracing Change and Impermanence

Navigating Change

Shetty teaches the importance of embracing change and understanding the impermanence of life. This perspective is vital in adapting to financial fluctuations and uncertainties.

Adaptability in Financial Planning

Stay flexible with your financial plans. Life events such as job changes, market fluctuations, or unexpected expenses require adaptability. Regularly review and adjust your financial strategies to navigate these changes effectively.

Authenticity and Integrity

Value of Authenticity

Authenticity and integrity are fundamental to living a harmonious life. Shetty encourages aligning actions with beliefs and values.

Authentic Financial Decisions

Make financial decisions that reflect your true values and integrity. Avoid investments or expenditures that don’t align with your ethical beliefs. Authenticity in financial planning fosters trust and satisfaction in your financial journey.

Summary

“Think Like a Monk” by Jay Shetty offers timeless wisdom that can profoundly impact our financial and personal lives. By embracing these ten lessons—purpose and passion, mindfulness and meditation, gratitude and positivity, overcoming negativity, relationships and connection, service and contribution, inner growth and self-discovery, living with intention, embracing change and impermanence, and authenticity and integrity—we can achieve a richer, more fulfilling existence.

Implementing these insights in our financial plans not only helps us accumulate wealth but also ensures that our financial journey is aligned with our deeper values and purpose. As we navigate the complexities of financial planning, let’s remember that true richness comes from a harmonious balance of wealth, wisdom, and personal fulfillment.

Listen to the book in Audible

The author of this article, Taresh Bhatia, is a Certified Financial Planner® and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2025: All Rights Reserved. Taresh Bhatia. Certified Financial Planner®

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here