Introduction:

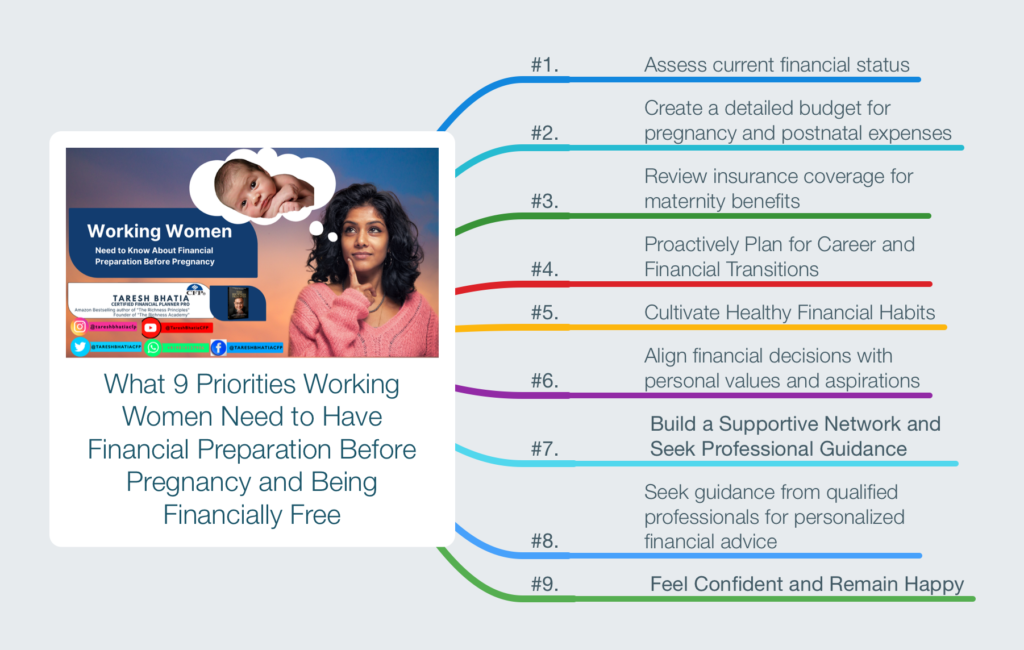

Discover the nine essential priorities that working women need to address for financial preparation before pregnancy. Empower yourself to achieve financial freedom while embracing the journey of motherhood.

Welcoming a new life into the world is an exhilarating journey, especially for working women who navigate the delicate balance of career and family.

As a Certified Financial Planner and advocate for female empowerment, I recognize

the unique challenges and opportunities that working women face as they prepare for

parenthood.

In this guide, tailored specifically for the dynamic needs of working women, we delve

into the essential steps to ensure financial readiness before pregnancy, empowering

you to embrace motherhood with confidence and financial freedom.

Understanding the Financial Landscape for Working Women:

Before embarking on the journey of motherhood, it’s crucial for working women to gain a comprehensive understanding of their financial situation. This includes assessing income, expenses, savings, and existing financial commitments. By aligning financial goals with career aspirations, working women can lay a solid foundation for their growing family while continuing to pursue professional success.

Anticipating Expenses with a Working Woman’s Perspective:

Working women often face unique expenses related to pregnancy, childbirth, and childcare while balancing the demands of their careers. It’s essential to categorize these expenses meticulously, considering factors such as maternity leave, childcare costs, and potential career interruptions. By creating a detailed budget tailored to the specific needs of working women, financial planning becomes a tool for empowerment rather than a source of stress.

Leveraging Insurance Benefits for Working Women:

Insurance plays a crucial role in providing financial security for working women before, during, and after pregnancy. Understanding the maternity benefits offered by health insurance policies is essential to maximize coverage and minimize out-of-pocket expenses. Working women should also explore supplemental insurance options to ensure comprehensive coverage for maternity-related expenses, safeguarding both their health and financial well-being.

The Power of Preemptive Planning for Working Women:

Preemptive planning is essential for working women preparing for pregnancy, as it allows them to anticipate and address potential challenges proactively. This includes discussing career goals and parental leave policies with employers, exploring flexible work arrangements, and creating a financial safety net to mitigate the impact of any career interruptions. By taking control of their financial future, working women can navigate the transition to motherhood with confidence and resilience.

Cultivating Financial Habits for Working Women:

Financial planning is not only about preparing for the immediate needs of pregnancy and childbirth but also about laying the groundwork for long-term financial success. Working women should prioritize saving and investing, taking advantage of employer-sponsored retirement plans and other investment opportunities. By cultivating a habit of financial discipline and planning for the future, working women can achieve greater financial independence and security for themselves and their families.

Aligning Values and Beliefs in Financial Planning:

As working women prepare for motherhood, it’s essential to align their financial decisions with their values and beliefs. This includes considering factors such as career goals, family priorities, and personal aspirations when making financial choices. By integrating their professional and personal lives, working women can create a holistic approach to financial planning that reflects their unique circumstances and aspirations.

Building a Supportive Network for Working Women:

Navigating the financial complexities of pregnancy and motherhood can be challenging, but working women don’t have to do it alone. Building a supportive network of family, friends, and professional advisors can provide valuable guidance and encouragement along the way. Whether seeking advice on career advancement, childcare options, or financial planning strategies, working women can benefit from the wisdom and support of those around them.

Conclusion:

As working women prepare for the transformative journey of motherhood, financial preparation becomes a cornerstone of empowerment and resilience. By understanding the unique financial challenges and opportunities they face, working women can embrace parenthood with confidence and financial freedom. Remember, you are not alone in this journey. Seek support from qualified professionals and leverage your network of peers to navigate the path to motherhood with grace and determination. With careful planning and perseverance, working women can achieve their dreams of both professional success and personal fulfillment.

Action Plan for Working Women’s Financial Preparation Before Pregnancy:

- Assess Your Current Financial Situation:

- Take stock of your income, expenses, savings, and existing financial commitments.

- Consider how pregnancy and potential career interruptions may impact your financial stability.

- Evaluate your long-term financial goals and aspirations, both personally and professionally.

- Create a Detailed Budget Tailored to Working Women’s Needs:

- Identify specific expenses related to pregnancy, childbirth, and childcare, taking into account your career obligations.

- Allocate funds for maternity leave, medical expenses, childcare costs, and any potential reduction in income during maternity leave.

- Ensure that your budget reflects both short-term needs and long-term financial goals, such as retirement planning and children’s education.

- Maximize Insurance Coverage for Working Women:

- Review your health insurance policy to understand coverage options for maternity-related expenses.

- Consider supplemental insurance plans, such as maternity insurance or critical illness coverage, to enhance financial protection during pregnancy.

- Explore disability insurance options to safeguard your income in case of unexpected medical complications or career interruptions.

- Proactively Plan for Career and Financial Transitions:

- Discuss parental leave policies and flexible work arrangements with your employer to ensure a smooth transition to motherhood.

- Develop a plan for managing your workload and responsibilities during pregnancy and maternity leave, including delegating tasks and setting realistic expectations.

- Explore alternative income streams or savings strategies to compensate for any temporary reduction in income during maternity leave.

- Cultivate Healthy Financial Habits:

- Prioritize saving and investing, taking advantage of employer-sponsored retirement plans and other investment opportunities.

- Set aside a portion of your income each month for emergency savings and future financial goals.

- Automate your savings contributions to ensure consistency and discipline in your financial habits.

- Align Your Financial Decisions with Your Values and Goals:

- Consider how your career aspirations, family priorities, and personal beliefs influence your financial decisions.

- Seek opportunities to integrate your professional and personal lives, finding ways to balance your career ambitions with your desire for a fulfilling family life.

- Make intentional choices that align with your values and aspirations, both in your career and your financial planning.

- Build a Supportive Network and Seek Professional Guidance:

- Surround yourself with supportive friends, family members, and colleagues who understand the unique challenges of working women.

- Seek guidance from qualified professionals, such as Certified Financial Planners, career counselors, and healthcare providers, to navigate the complexities of pregnancy and financial planning.

- Take advantage of resources and support networks specifically tailored to working women, such as professional associations, online forums, and mentorship programs.

- Seek guidance from qualified professionals for personalized financial advice

- Feel Confident and Remain Happy

By following this action plan, working women can proactively prepare for the financial implications of pregnancy while maintaining their professional aspirations and personal well-being. Remember that financial planning is a journey, and seeking support and guidance along the way can help you navigate the path to motherhood with confidence and resilience.

The author of this article, Taresh Bhatia, is a Certified Financial Planner and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2024: All Rights Reserved. Taresh Bhatia.

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here