Key Changes Every Investor Must Know

INTRODUCTION: FROM RIGID PENSION TO FLEXIBLE RETIREMENT TOOL

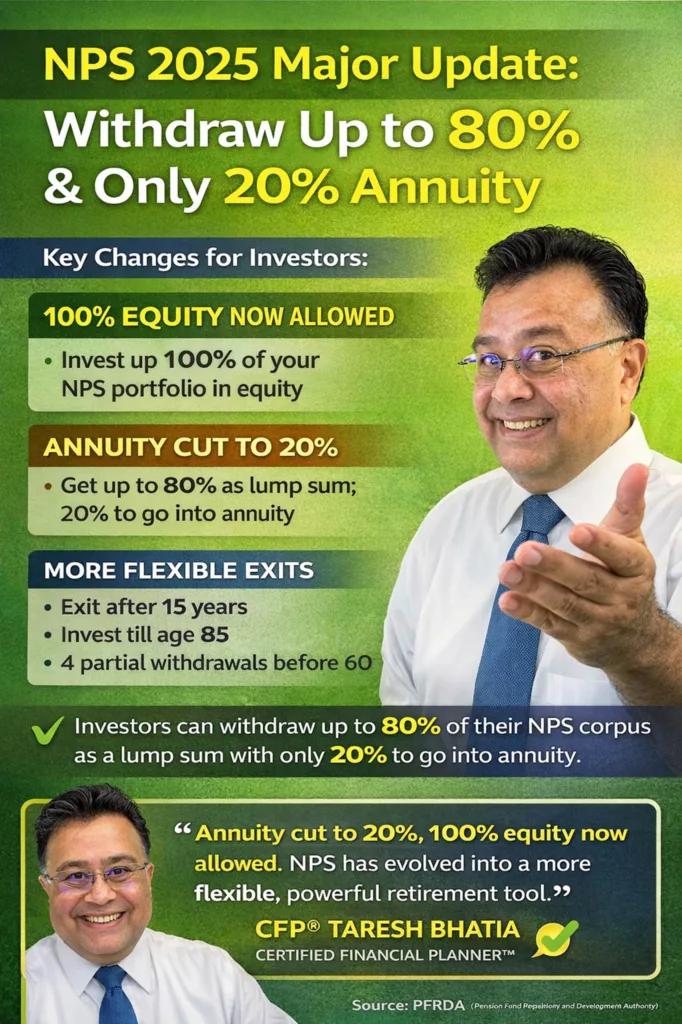

For years, the National Pension System (NPS) carried a reputation of being too rigid, too conservative, and too restrictive. Many investors liked its tax benefits but struggled with its tight exit rules, capped equity exposure, and forced annuitisation.

That perception has now fundamentally changed.

Over the last few months—and especially with the latest regulatory changes notified by the Pension Fund Regulatory and Development Authority (PFRDA)—NPS has quietly transformed into one of India’s most flexible, market-linked retirement products.

As a CFP® working closely with Indian families and professionals, I see this as one of the most important retirement reforms in recent years.

Let me break this down clearly—what has changed, why it matters, and how investors should respond.

1. EQUITY EXPOSURE: NOW UP TO 100%

One of the most significant but under-discussed changes is this:

👉 NPS subscribers can now allocate up to 100% of their portfolio to equity.

Earlier:

• Equity exposure was capped at 75%

• NPS felt conservative compared to mutual funds

Now:

• 100% equity allocation is allowed

• Within this, up to 5% can be allocated to gold, silver, and alternative assets

What this means in simple terms:

• NPS is no longer just a pension product

• It now competes with mutual funds as a long-term wealth-creation tool

• Young investors can fully harness equity compounding inside a low-cost, tax-efficient structure

📌 CFP Insight:

Just because 100% equity is allowed does not mean it is suitable for everyone. Asset allocation must still align with age, income stability, and retirement horizon.

2. THE BIGGEST MENTAL BLOCK REMOVED: ANNUITY CUT TO 20%

This is the change that has completely altered investor sentiment.

Earlier:

• At least 40% of the NPS corpus had to be compulsorily annuitised

• This deterred many investors due to:

• Low annuity returns

• Zero liquidity

• No inflation protection

Now:

👉 Mandatory annuitisation reduced to just 20%

👉 Up to 80% of the corpus can be withdrawn

This is not the removal of annuity—it is the restoration of choice.

Why annuities still matter:

Annuities are the only financial product that protects against longevity risk—the risk of outliving your money.

But forcing everyone into a 40% annuity was excessive.

📌 What PFRDA has done right:

• Retained annuities for lifelong income

• Removed compulsion

• Expanded flexibility

Anyone can still annuitise 40%, 60%, or even 100%—but now it’s a decision, not a mandate.

3. NEW WITHDRAWAL SLABS (CLEAR & PRACTICAL)

✅ Corpus ≤ ₹8 lakh

• 100% lump-sum withdrawal allowed

• No annuity required

✅ Corpus ₹8–12 lakh (New Middle Slab)

• Up to ₹6 lakh lump sum

• Balance via annuity or Systematic Unit Redemption (SUR)

✅ Corpus > ₹12 lakh

• At least 20% annuity mandatory

• Up to 80% withdrawal allowed

This middle slab is extremely important—it prevents poor decisions by allowing flexibility without encouraging misuse.

4. SYSTEMATIC UNIT REDEMPTION (SUR): A GAME CHANGER

Earlier, NPS withdrawals were binary—either lump sum or annuity.

Now:

👉 SUR allows gradual withdrawals over at least 6 years

👉 Similar to SWP in mutual funds

👉 Remaining corpus stays invested and continues compounding

Why this matters:

• Prevents mismanagement of large lump sums

• Improves post-retirement cash-flow discipline

• Aligns NPS with modern retirement planning globally

📌 CFP View:

SUR is one of the smartest additions to NPS. It protects retirees from themselves.

5. EXIT RULES: NO LONGER LOCKED TILL 60

Earlier:

• Exit before 60 was practically impossible

Now:

👉 Exit allowed after completing 15 years of subscription

Example:

• Start NPS at 30

• Eligible to exit at 45

This makes NPS more flexible for:

• Entrepreneurs

• Career switchers

• Professionals with international mobility

6. PARTIAL WITHDRAWALS: MORE FLEXIBLE, STILL DISCIPLINED

Before:

• Only 3 partial withdrawals

Now:

• 4 partial withdrawals allowed

• Minimum 4-year gap between withdrawals

Post-60:

• Subscribers staying invested beyond 60 can make partial withdrawals

• Minimum 3-year gap

• Each withdrawal capped at 25% of own contribution

📌 Important Reminder:

Every withdrawal breaks compounding. This facility is for need, not convenience.

7. STAY INVESTED TILL 85 (EARLIER 75)

Another subtle but powerful change:

👉 Maximum investment age increased to 85

This benefits:

• Late retirees

• Those who don’t need immediate withdrawals

• Investors managing tax timing and cash flows strategically

8. COSTS HAVE RISEN—BUT CONTEXT MATTERS

Yes, fund management charges have increased:

• From ~0.09% earlier

• To ~0.3% now

Even after this:

• NPS remains one of the lowest-cost retirement products globally

• Still significantly cheaper than most mutual funds

📌 Cost should always be judged relative to value and flexibility gained.

9. THE BIG UNANSWERED QUESTION: TAX ON EXTRA 20%?

Earlier:

• Up to 60% lump sum was tax-free

Now:

• Withdrawal allowed up to 80%

• Tax treatment of the additional 20% is still unclear

Important facts:

• PFRDA does not decide taxation

• This lies with the Ministry of Finance

• Tax applies to income components, not principal

Possible approaches:

1. Mutual-fund-like taxation

2. AIF-style segregation

3. Full exemption (cleanest solution)

📌 Until clarity emerges, withdrawals must be planned conservatively.

FINAL CFP® TAKEAWAY: WHAT INVESTORS SHOULD DO NOW

1️⃣ Don’t treat NPS as old-style pension anymore

2️⃣ Use equity exposure intelligently, not emotionally

3️⃣ Combine annuity + SUR for stable retirement income

4️⃣ Avoid frequent withdrawals—protect compounding

5️⃣ Integrate NPS into a full financial plan, not in isolation

“NPS has finally moved from compulsion to choice. But choice without planning can be dangerous. Discipline is still the real retirement insurance.”

— CFP® Taresh Bhatia

Disclaimer: The views expressed are for educational purposes only and do not constitute financial, investment, tax, or legal advice. Please consult qualified professionals before making decisions. Mutual fund investments are subject to market risks.

👉 Full Disclaimer | Disclosures | Terms of Use

| 👉Join my FAN page at: | facebook.com/CFPTareshBhatia |

| 👉Follow on Facebook: | facebook.com/TareshBhatiaCFPro |

| 👉Follow me on Instagram: | instagram.com/tareshbhatiacfp |

| 👉Follow me on Threads: | threads.net/@tareshbhatiacfp |

| 👉Follow me on Twitter: | twitter.com/tareshbhatiacfp |

| 👉Follow me on LinkedIn: | linkedin.com/in/tareshbhatiacfp |

| 👉Visit Website: | tareshbhatia.com |

| 👉Read Blog: | blog.tareshbhatia.com |

| 👉Buy my Book: | pages.razorpay.com/BookTRP |

| 👉Join me on Telegram: | t.me/+v0ewUJQU0wowN2Jl |

| 👉YouTube Channel: | youtube.com/@Taresh-Bhatia |

| 👉Subscribe: | tinyurl.com/SubscTB |

| 👉Join my Academy: | therichnessacademy.com |

| 👉Complimentary Session-Limited Offer: | learn.therichnessacademy.com/web/checkout/686f9d1203ac6c6374689439 |

| 👉WhatsApp message directly: | wa.me/919810127906 |

| 👉Get Ebook: | tinyurl.com/TenEbook |

The author of this article, Taresh Bhatia, is a Certified Financial Planner® and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2025: All Rights Reserved. Taresh Bhatia. Certified Financial Planner®

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here