Introduction: Navigating the Spectrum of Personality in Financial Planning

In the dynamic realm of financial planning, success hinges not only on sound investment strategies and market insights but also on the ability diverse personalities of clients. As a

Certified Financial Planner (CFP), I am acutely aware of the profound impact that individual behaviours, preferences, and communication styles can have on the financial decision-making process.

Within this context, the insights offered by Thomas Erikson in “Surrounded by Idiots” resonate deeply, providing a blueprint for navigating the intricacies of human nature in pursuit of financial prosperity.

Erikson’s classification of personalities into four distinct colors—Red, Yellow, Green, and Blue—serves as a guiding framework, offering invaluable insights into the varied traits and tendencies exhibited by clients.

Each color represents a unique spectrum of characteristics that shape how individuals approach financial planning, from risk tolerance and investment preferences to communication styles and decision-making processes.

Understanding the Four Colour Personalities-

At the heart of Erikson’s framework lies a fundamental recognition of the multifaceted nature of human behaviour.

| Personality Type | Characteristics |

| Red | Assertive, risk-taking, desire for growth and achievement |

| Yellow | Collaborative, values social impact, seeks alignment with values |

| Green | Calm, stable, prioritizes wealth preservation and risk management |

| Blue | Analytical, precise, relies on data-driven insights for decisions |

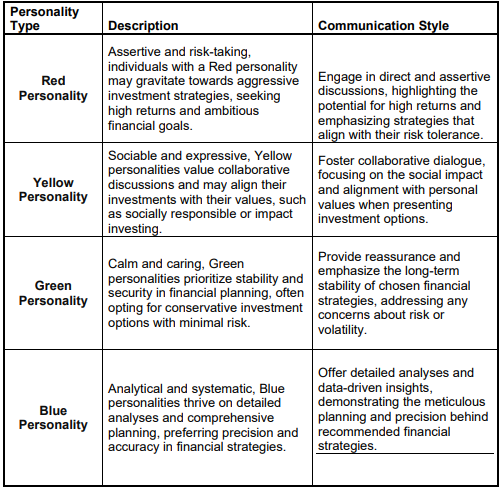

Adapting Communication Styles

Effective communication lies at the crux of successful financial planning, and understanding clients’ personality types is essential in tailoring communication strategies to resonate with individual preferences.

For Red personalities, direct and assertive discussions highlighting opportunities for growth are critical, while Yellow personalities respond well to collaborative dialogue and discussions around social impact. Green personalities require reassurance and stability, while Blue personalities thrive on detailed analyses and structured presentations.

Identifying Clients’ Personality Types

Accurately identifying clients’ personality types is a strategic imperative for CFP professionals seeking to optimize client engagement and financial outcomes. Through keen observational skills, active listening, and, where appropriate, psychometric assessments, CFP professionals can adeptly navigate the nuances of different personality profiles.

| This table succinctly highlights the key traits associated with each personality type, providing a clear overview of their distinguishing characteristics. | |

| Red | Confidence, Decisiveness |

| Yellow | Sociability, Enthusiasm |

| Green | Stability, Security |

| Blue | Analytical Rigor, Attention to Detail |

Red personalities exhibit confidence and decisiveness, Yellow personalities exude sociability and enthusiasm, Green personalities prioritize stability and security, and Blue personalities demonstrate analytical rigour and attention to detail.

Tailoring Financial Strategies

By recognizing and adapting to clients’ personality types, CFP professionals can tailor financial strategies to align with individual preferences and priorities. For Red personalities, this may involve exploring aggressive investment options that capitalize on their appetite for risk, while Yellow personalities may benefit from investments that offer social impact and align with personal values. Green personalities require conservative strategies that prioritize capital preservation, while Blue personalities thrive on detailed analyses and structured planning.

Let us embark on a journey through Erikson’s lessons and explore how they intertwine with financial planning, equipping CFP professionals with actionable strategies to empower clients towards financial success.

Avoiding Mislabeling and Stereotypes

While personality frameworks offer valuable insights, it is crucial to avoid the trap of pigeonholing individuals into rigid categories. Each client is a nuanced blend of personality traits shaped by unique experiences and circumstances:

- Personalization is Key: Recognize each client’s individuality and tailor financial advice to their specific needs, avoiding one-size-fits-all solutions.

- Flexibility and Adaptability: Remain open to evolving client preferences and adjust communication strategies accordingly, fostering trust and collaboration.

- Continuous Learning: Embrace ongoing education and refinement of communication skills, staying attuned to emerging trends and advancements in personality psychology.

Empowering Financial Success

Incorporating insights from “Surrounded by Idiots” into financial planning practices can yield tangible benefits for both CFP professionals and their clients:

- Enhanced Client Relationships: By understanding clients on a deeper level, CFP professionals can foster stronger connections and build trust, laying the foundation for long-term partnerships.

- Tailored Financial Strategies: Personalized financial plans that resonate with clients’ personalities are more likely to be embraced and implemented, leading to greater confidence and commitment towards financial goals.

- Improved Outcomes: When clients feel understood and valued, they are more likely to actively engage in the financial planning process, resulting in improved outcomes and a sense of empowerment over their financial future.

In conclusion, integrating personality insights into financial planning practices offers a transformative approach to achieving success in the ever-evolving landscape of personal finance. By embracing the diversity of human behavior and adapting communication strategies to meet individual needs, CFP professionals can help their clients navigate towards financial prosperity with clarity and confidence.

Identifying Clients’ Personality Types: A Strategic Approach for CFP Professionals

As Certified Financial Planner (CFP) professionals, the ability to accurately identify clients’ personality types lays the groundwork for effective communication and tailored financial strategies. While understanding the theoretical framework of personality types is valuable, the practical application lies in recognizing visible traits and behaviours exhibited by clients. Here is a comprehensive guide on how CFP professionals can adeptly identify and navigate the nuances of different personality types:

1. Observational Skills:

a. Behavioral Patterns: Pay close attention to clients’ behavioural patterns during initial consultations and subsequent interactions. Notice how they express themselves, react to financial discussions, and approach decision-making processes.

b. Communication Styles: Observe clients’ preferred modes of communication, whether they prefer direct and assertive interactions (Red), collaborative and engaging discussions (Yellow), calm and empathetic conversations (Green), or structured and analytical presentations (Blue).

2. Active Listening:

a. Verbal Cues: Listen attentively to clients’ verbal cues, including tone of voice, choice of words, and level of engagement. Note any recurring themes or concerns that may indicate underlying personality traits.

b. Non-Verbal Cues: Pay attention to non-verbal cues such as body language, facial expressions, and gestures. These subtle indicators can offer valuable insights into clients’ emotional states and communication preferences.

3. Psychometric Assessments:

a. Personality Inventories: Consider utilizing validated psychometric assessments, such as the Myers-Briggs Type Indicator (MBTI) or DISC assessment, to gain deeper insights into clients’ personality preferences and tendencies.

b. Online Tools: Explore online resources and platforms that offer personality quizzes and assessments, which clients can complete independently to provide supplementary insights into their personality profiles.

Visible Traits of Each Personality Type:

| Personality Type | Visible Traits | Financial Behaviors |

| Red | Confident, assertive, decisive, action-oriented | Willingness to take risks, desire for high returns, preference for aggressive investment strategies |

| Yellow | Sociable, enthusiastic, expressive, relationship-oriented | Preference for collaborative decision-making, emphasis on social impact, alignment with personal values in investment choices |

| Green | Calm, patient, empathetic, nurturing | Prioritization of financial stability, aversion to risk, preference for conservative investment options |

| Blue | Analytical, detail-oriented, systematic, logical | Thorough research and analysis, preference for structured financial plans, emphasis on accuracy and precision |

Actions for Each Personality Type:

| Personality Type | Actions |

| Red Personality | Engage Proactively |

| Initiate direct and assertive discussions, highlighting opportunities for growth and achievement. | |

| Provide Challenges | |

| Present investment options that offer the potential for high returns and capitalize on their appetite for risk. | |

| Yellow Personality | Foster Collaboration |

| Encourage open dialogue and active participation in financial planning discussions. | |

| Highlight Values | |

| Emphasize investment opportunities that align with their personal values and societal impact. | |

| Green Personality | Offer Reassurance |

| Provide a sense of security and stability by focusing on conservative investment strategies and long-term financial planning | |

| Demonstrate Empathy | |

| Acknowledge their concerns and anxieties, offering empathetic support and guidance throughout the process. | |

| Blue Personality | Provide Detailed Analysis |

| Offer comprehensive financial analyses and data-driven insights to satisfy their need for precision and accuracy. | |

| Offer Structure | |

| Present structured financial plans with clear objectives and measurable outcomes to align with their systematic approach. |

Benefits for the Profession:

a. Enhanced Client Relationships:

- By accurately identifying clients’ personality types, CFP professionals can establish deeper connections and foster trust, leading to stronger client relationships and long-term loyalty.

b. Tailored Financial Strategies:

- Customizing financial strategies to align with clients’ personality preferences increases the likelihood of plan acceptance and implementation. Resulting in greater client satisfaction and improved outcomes.

c. Improved Communication:

- Understanding clients’ communication styles allows CFP professionals to tailor their approach. Resulting in more precise and more effective communication, reducing misunderstandings and enhancing collaboration.

d. Competitive Advantage:

- By incorporating personality insights into their practice, CFP professionals gain a competitive edge in the marketplace. Positioning themselves as trusted advisors capable of delivering personalized and impactful financial solutions.

Also read: How to Prioritize What Truly Matters: Insights from “The Subtle Art of Not Giving a F*ck”

In conclusion, the ability to identify clients’ personality types is a strategic imperative for CFP professionals seeking to optimize client engagement and financial outcomes. By honing observational skills, actively listening to verbal and non-verbal cues, and leveraging psychometric assessments, CFP professionals can adeptly navigate the diverse landscape of client personalities, offering tailored financial strategies that resonate with individual preferences and priorities. This proactive approach not only enhances client satisfaction and loyalty but also strengthens the overall credibility and effectiveness of the financial planning profession.

Let us dive deeper into each personality type from a first-person perspective, exploring how I, as a CFP professional, would handle and engage with clients of varying personality profiles:

| Personality Type | Initial Approach | Distinct Signals | Probing Further | Avoidance |

| Red | Adopt a direct and assertive approach, focusing on growth and achievement. | Exudes confidence and decisiveness, displays eagerness for aggressive investment strategies. | Delve deeper into risk appetite and long-term aspirations. | Avoid encouraging overly speculative or imprudent investment decisions. Emphasize diversification and portfolio resilience. |

| Yellow | Foster open dialogue and active participation, emphasizing social impact. | Exhibits sociability and enthusiasm, shows interest in meaningful relationships. | Probe into philanthropic interests and personal values. | Avoid overlooking sound financial planning principles. Balance social impact with long-term financial security. |

| Green | Prioritize empathy and reassurance, emphasizing stability and security. | Exudes calmness and patience, displays preference for low-volatility strategies. | Investigate risk aversion and financial objectives. | Avoid overemphasizing caution. Strike a balance between risk mitigation and growth opportunities. |

| Blue | Adopt a systematic and analytical approach, providing structured presentations. | Exhibits a logical and systematic mindset, shows keen interest in detailed analysis. | Probe into information needs and decision-making criteria. | Avoid overwhelming with complexity. Communicate financial concepts clearly and accessibly. |

Conclusion: Empowering Financial Success Through Personalization

In conclusion, the integration of personality insights into financial planning practices offers a transformative approach towards achieving success. By harnessing the lessons from and adeptly navigating the spectrum of personality, CFP professionals can forge deeper connections with clients. Tailor financial strategies to individual needs, and empower them to navigate towards financial prosperity with clarity and confidence. Through a nuanced understanding of personality types, CFP professionals can elevate their practice. Enhance client relationships, and ultimately drive meaningful outcomes in the pursuit of financial well-being.

Here is the link to buy the book: https://amzn.to/4aluC6b

Listen to book in Audible: https://www.audible.in/pd/Surrounded-by-Idiots-Audiobook/B07TJ1XZWP?action_code=ASSGB149080119000H&share_location=pdp

The author of this article, Taresh Bhatia, is a Certified Financial Planner® and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2025: All Rights Reserved. Taresh Bhatia. Certified Financial Planner®

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here