Introduction:

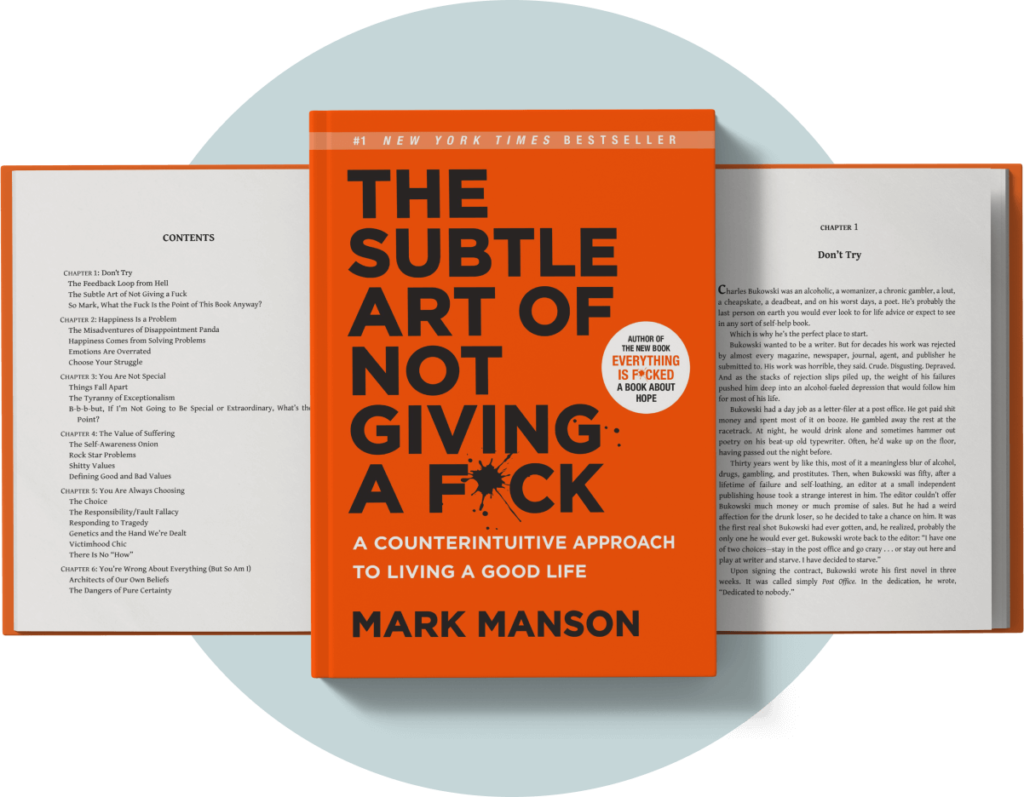

As a dedicated Certified Financial Planner, I seek insights from various sources to enrich my practice and help clients. One such source that resonates profoundly is “The Subtle Art of Not Giving a F*ck” by Mark Manson.

Let’s explore how the unconventional wisdom shared in book aligns with principles of personal finance and the pursuit of happiness. From prioritizing what truly matters to embracing failure and rejection. Each lesson offers valuable guidance for individuals seeking both financial well-being and genuine fulfillment in life.

The Subtle Art of Not Giving a F*ck” by Mark Manson is a self-help book that challenges conventional wisdom.

Here are 10 lessons from the book:

1. Focus on What Truly Matters:

Identify your core values and focus your energy on what truly matters to you. Manson advocates for letting go of trivial concerns and prioritizing what aligns with your values and goals.

2. Embrace Uncertainty:

Accept that life is inherently uncertain and unpredictable. Manson encourages readers to embrace uncertainty rather than seeking certainty or security. As growth and fulfillment often arise from facing challenges and uncertainty.

3. Take Responsibility for Your Life:

Take ownership of your choices and actions. Manson emphasizes the importance of personal responsibility and accountability in creating a fulfilling life.

4. Set Boundaries:

Establish clear boundaries and learn to say no to things that don’t align with your values or goals. Manson teaches readers to prioritize their own well-being and set healthy boundaries in relationships and other areas of life.

5. Accept Imperfection:

Embrace your imperfections and accept that life is messy and imperfect. Manson encourages readers to embrace their flaws, vulnerabilities, letting go of the pursuit of perfection, as part of being human

6. Focus on Process Over Outcome:

Shift your focus from outcome-based goals to the process of growth and self-improvement. Manson advocates for enjoying the journey, embracing challenges, and setbacks, rather than fixating on achieving specific outcomes.

7. Choose Your F*cks Wisely:

Be selective about where you invest your time, energy, and attention. Manson advises readers to choose their “f*cks” wisely, focusing on what brings true fulfillment and meaning.

8. Embrace Failure and Rejection:

Embrace failure and rejection as opportunities for growth and learning. Manson encourages readers to reframe failure as natural part of the learning and to persevere in the face of setbacks.

9. Cultivate Gratitude and Acceptance:

Cultivate gratitude for what you have and accept the things you cannot change. Manson teaches readers to find contentment and peace by focusing on the present moment and appreciating the blessings in their lives

10. Live Authentically:

Be true to yourself and live authentically, even if it means going against societal expectations or norms. Manson encourages readers to live in alignment with their values, passions, and desires, rather than seeking approval or validation from others.

These lessons from “The Subtle Art of Not Giving a F*ck” offer valuable insights and practical advice for living a more authentic, fulfilling, and meaningful life.

Buy Book: https://amzn.to/3UkR22R

You can also get the AUDIO BOOK for FREE using the same link. Use the link to register for the AUDIO BOOK on Audible and start enjoying it.

As a Certified Financial Planner Professional deeply invested in helping individuals navigate their financial journeys, I find the lessons from “The Subtle Art of Not Giving a F*ck” immensely relevant, particularly in the realm of personal finance and pursuing happiness.

Let’s delve into how these insights resonate with the pursuit of financial well-being and overall contentment:

1. Prioritizing What Truly Matters:

In personal finance, it’s crucial to identify our core financial goals and values. Just as Manson urges us to focus on what truly matters in life, I encourage clients to prioritize financial decisions aligned with their long-term aspirations, whether it’s buying a home, saving for retirement, or funding their children’s education.

2. Embracing Uncertainty:

Financial planning involves navigating through various uncertainties, such as market fluctuations, job changes, or unexpected expenses. By embracing uncertainty, we can approach financial decisions with a sense of adaptability and resilience, understanding that setbacks are part of the journey towards financial security and happiness.

3. Taking Responsibility for Your Financial Life:

Similar to taking ownership of one’s life, taking responsibility for financial decisions empowers individuals to steer their financial futures. Encouraging clients to make informed choices, stay disciplined with budgeting and saving, and seek professional guidance when needed aligns with Manson’s emphasis on personal responsibility.

4. Setting Boundaries:

Establishing financial boundaries involves creating a budget, managing debt, and making intentional spending choices. Just as setting personal boundaries fosters healthy relationships, setting financial boundaries ensures that individuals allocate resources according to their priorities, leading to greater financial stability and peace of mind.

5. Accepting Imperfection:

Financial journeys are rarely flawless, and embracing imperfections, such as occasional overspending or investment losses, is essential. By accepting these imperfections and learning from mistakes, individuals can cultivate a healthier relationship with money and avoid unnecessary stress or guilt.

6. Choosing Your Financial F*cks Wisely:

In personal finance, it’s vital to prioritize financial goals and avoid getting caught up in comparison or societal pressure to overspend. By choosing to allocate resources towards meaningful financial goals rather than chasing materialistic desires, individuals can achieve greater financial satisfaction and happiness.

7. Embracing Failure and Rejection:

Financial setbacks are inevitable, whether it’s a business venture that doesn’t succeed or an investment that underperforms. Viewing these setbacks as learning opportunities, rather than failures, allows individuals to grow from experiences and make more informed financial decisions in the future.

8. Cultivating Gratitude and Contentment:

While financial success is essential, true happiness stems from gratitude for what one already has. Encouraging clients to cultivate gratitude for their financial blessings, whether it’s a steady income, supportive relationships, or good health, fosters a sense of contentment and reduces the urge for excessive consumption.

9. Living Authentically:

Lastly, aligning financial decisions with personal values and goals is key to living authentically. By pursuing financial goals that are meaningful and fulfilling, individuals can experience a deeper sense of satisfaction and purpose in life, independent of external validation or societal expectations.

In essence, the connection between money and happiness lies not in the pursuit of wealth for its own sake, but in using financial resources to support a fulfilling and meaningful life. By integrating the principles from “The Subtle Art of Not Giving a F*ck” into financial planning practices, I aim to empower clients to achieve not only financial success but also lasting happiness and contentment.

Summary:

In “The Subtle Art of Not Giving a Fck,” Mark Manson challenges conventional wisdom and offers unconventional advice on living a more fulfilling life. Through ten key lessons, Manson emphasizes the importance of prioritizing what truly matters, embracing uncertainty, taking responsibility for one’s life, setting boundaries, accepting imperfection, focusing on the process over the outcome, choosing one’s “fcks” wisely, embracing failure and rejection, cultivating gratitude and acceptance, and living authentically. These lessons not only resonate with personal development but also hold significant relevance in the realm of personal finance. By integrating Manson’s insights into financial planning practices, individuals can navigate their financial journeys with greater clarity, purpose, and contentment, ultimately leading to a more fulfilling and meaningful life.

The author of this article is Taresh Bhatia, a Financial Freedom Specialist, qualified as a CERTIFIED FINANCIAL PLANNER PRO who has authored an Amazon best seller-“The Richness Principles”. He can be reached at taresh@tareshbhatia.com

©️2024: All Rights Reserved. Taresh Bhatia

Subscribe Now for Upcoming Blogs!