Introduction

In the vast landscape of personal finance, retirement planning isn’t just a destination; it’s a journey laden with mysteries waiting to be unraveled. As Indians increasingly embrace avenues like SIPs for wealth creation, there lies an untapped treasure trove often overlooked: Systematic Withdrawal Plans (SWP). And who better to guide us through this financial labyrinth than Taresh Bhatia, the maestro of financial wisdom and a Certified Financial Planner par excellence?

Unveiling the Secrets of SWP

- The Art of Financial Choreography: Imagine SWP as a carefully choreographed dance, where each withdrawal is a graceful step towards financial freedom. It’s the subtle rhythm that ensures your financial orchestra plays harmoniously.

- Embarking on the SWP Journey with Indian Tales-Meet Raj and Priya: The Mumbai Dreamers: Raj and Priya, a spirited duo from Mumbai, envisioned a retirement filled with leisurely strolls by the beach and indulgent chai sessions. By implementing SWP, they scripted a financial saga where every withdrawal funded their dreams without depleting their treasure chest.

- Illustration: With a retirement corpus of Rs. 1 crore, Raj and Priya set sail on their SWP voyage with a conservative withdrawal rate of 6% annually, ensuring a steady income of Rs. 6 lakhs per year to fund their adventures.

- The Delhi Dilemma of Ramesh and Sunita: Ramesh and Sunita, a quintessential Delhi couple, grappled with the uncertainties of post-retirement life. SWP emerged as their guiding star, illuminating a path where financial worries were replaced by the bliss of serenity.

- Illustration: Armed with a retirement corpus of Rs. 75 lakhs, Ramesh and Sunita charted their SWP strategy, opting for a withdrawal rate of 5% annually. This translated to a comforting income stream of Rs. 37,500 per month, ensuring their twilight years were devoid of financial storms.

Cracking the Code: SWP Strategies Unveiled

- The Quantum Leap of Tax Efficiency: While tax liabilities loom large over conventional investments like Fixed Deposits, SWP offers a sanctuary of tax efficiency. By taxing only the capital gains, it paves the way for a smoother financial voyage.

- The Saga of Priya’s Tax Savvy Maneuver: Priya, a savvy investor from Delhi, chose SWP as her financial ally, navigating the labyrinth of tax laws with finesse. With every withdrawal, she not only secured her financial future but also minimized her tax burdens.

- Illustration: Priya’s prudent choice of SWP not only ensured a steady income stream but also minimized her tax liabilities. With a corpus of Rs. 50 lakhs, her SWP strategy translated into a tax-efficient income of Rs. 25,000 per month, leaving ample room for her financial aspirations to soar.

- Decoding the SWP Symphony: As you embark on your SWP journey, remember, each financial odyssey is unique. Seek the counsel of financial wizards like Taresh Bhatia to craft a bespoke SWP strategy.

Key Ingredients for Planning SWP

- Rate of Withdrawal: The rate of withdrawal hinges on several factors such as monthly expenses, inflation rate, investment corpus, and portfolio returns. It’s the delicate balance between sustaining your lifestyle and preserving your wealth.

- Risk Appetite: Your risk appetite isn’t just a number; it’s the compass guiding your SWP strategy. A robust withdrawal risk strategy aligns with your risk tolerance, ensuring a smooth sail through market fluctuations.

- Household Expenses: Making proper household expenses forms the cornerstone of SWP planning. It’s the bedrock upon which your financial fortress stands, ensuring every withdrawal serves a purpose in sustaining your lifestyle.

- Health Insurance and Home Ownership: Safeguarding your health and securing a roof over your head are non-negotiables in SWP planning. Health insurance shields you from unexpected medical expenses, while owning a house provides a sense of security and reduces monthly expenses.

- Debt Management: Any ongoing debt or loans should be factored into your SWP strategy. A proactive approach to debt management ensures that your withdrawals aren’t burdened by looming liabilities.

- Anticipating Future Expenses: Peering into the crystal ball of future expenses allows you to tailor your SWP strategy accordingly. Whether it’s funding a grandchild’s education or embarking on a world tour, anticipating future expenses ensures your financial ship sails smoothly.

- Contingency Fund: Amidst the uncertainties of life, keeping a contingency fund aside is your financial lifeline. It’s the safety net that cushions you against unforeseen emergencies, ensuring your SWP journey remains uninterrupted.

SWP: A smarter way to manage periodic expenses

Tax advantage of SWPs

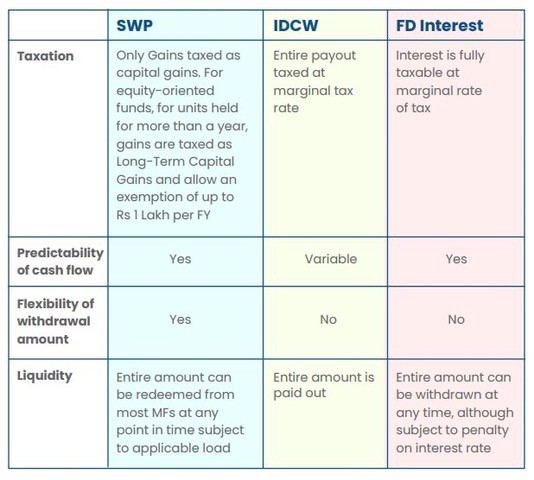

When you redeem MF units using SWP, you are taxed only on capital gains arising from the redemption. In contrast, for Fixed Deposits, entire interest income is taxable at marginal rate of tax. So making SWP more tax efficient as compared to Fixed income bearing instruments like FDs. Even IDCW (Income Distribution cum Capital Withdrawal) payouts are taxed in entirety at marginal rate of tax. Further, if you withdraw from an equity-oriented fund, for units held longer than 1 year, gains are treated as Long-term capital gains. It also allow for exemption of up to Rs 1 Lakhs in a particular FY

SWP vs IDCW- Apart from the tax advantage, SWP is more reliable in terms of cash flows compared to IDCW. Which are not assured periodic cash flows and are subject to availability of distributable surplus.

In Conclusion: Unraveling the Tapestry of Retirement Riches

As we stand at the cusp of retirement, SWP beckons as a gateway to unparalleled financial freedom. With its strategic prowess, tax efficiency, and approach, SWP isn’t just a financial tool, it’s the key to unlocking the enigma of retirement riches.

All said and done, each individual may have unique financial circumstances and risk appetite. It is recommended to consult a financial advisor to determine the appropriate withdrawal using SWP.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The author of this article is Taresh Bhatia, a CERTIFIED FINANCIAL PLANNER PRO who has authored an Amazon best seller-“The Richness Principles”. He can be reached at taresh@tareshbhatia.com

©️2024: All Rights Reserved. Taresh Bhatia

Subscribe Now for Upcoming Blogs!

📢 Join free live webinar —

Couple Finance Formula™ Register here