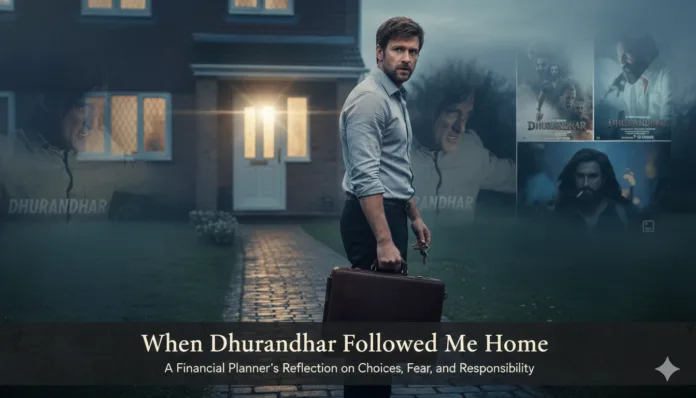

A CFP Reflection on Choices, Fear, and Responsibility

Some films entertain you in the theatre.

Some films follow you home.

Dhurandhar followed me home—not loudly, not dramatically—but quietly, like a thought that stays with you at a traffic signal long after the credits roll.

It wasn’t the action sequences that stayed with me.

It wasn’t even the twists.

What stayed with me were the human choices made under pressure—and how disturbingly familiar they felt to someone who has spent decades sitting across dining tables, listening to families talk about money, fear, and responsibility.

This is not a movie review.

This is a reflection.

The kind that happens when you are driving back home alone, replaying scenes—not as cinema, but as mirrors.

Let me take you through the moments that did this to me.

1. Hamza in Lyari: When “Managing” Masquerades as Stability

The Scene That Triggered It

When Hamza (Ranveer Singh) enters Lyari under a false identity, the film deliberately slows down. There is no heroism here. No big plan revealed. We watch him live modestly, earn trust slowly, do errands, observe people, and blend into an ecosystem that survives on routines rather than rules.

On the surface, everything appears functional:

• He has a place to sleep

• He has food

• He has a role to play

But as viewers, we feel the fragility.

There is no buffer. No margin. No resilience.

One unexpected event and everything collapses.

Why This Felt Uncomfortably Familiar

I see this exact phase in financial lives every single week.

People sit across from me and say:

• “We are managing somehow.”

• “EMIs are going.”

• “Salary is enough for now.”

Just like Hamza’s early days, nothing has broken yet.

But nothing has been designed either.

There is no structure.

Only adjustment.

And adjustment works—until it doesn’t.

That phase of the film reminded me of a truth I often repeat:

When life is running entirely on adjustment, it is only waiting for one shock.

2. Hamza and Rehman: The Silence That Changes Everything

The Scene That Lingers

As Hamza grows closer to Rehman (Akshaye Khanna), the relationship initially feels grounded in admiration. Rehman is decisive, ideological, commanding. But slowly—almost imperceptibly—something shifts.

His actions begin to cross moral lines.

His worldview hardens.

The cost of his choices becomes visible.

And yet, Hamza does not confront him.

There is no explosive argument.

No dramatic confrontation.

Just silence. Observation. Internal conflict.

The film handles this with restraint—and that is exactly why it works.

Why This Scene Hit Me as a Financial Planner

This is how financial damage begins in real households.

• A spouse senses financial stress but avoids the conversation.

• Someone notices overspending but says nothing.

• Parents postpone estate planning because “it may create tension.”

Silence feels peaceful in the moment.

But silence compounds.

That unspoken tension between Hamza and Rehman reminded me of how often money problems are not created by bad intent—but by delayed courage.

Avoiding discomfort today is how we invite crisis tomorrow.

3. The Jungle Betrayal: Decisions Made Under Emotional Overload

The Scene That Shook Me

The jungle sequence—where Hamza lures Rehman into a trap set by SP Aslam (Sanjay Dutt)—is one of the film’s most misunderstood moments if viewed only as a tactical move.

This is not a cold, calculated masterstroke.

Hamza is not calm here.

He is overwhelmed.

He is shaken by what Rehman has become.

He is drowning in guilt, fear, and urgency.

This is not strategy.

This is emotional overload.

A man choosing the least unbearable option in that moment.

The Financial Parallel I Could Not Ignore

I have seen investors do this exact thing:

• Selling everything after one market crash

• Abandoning long-term plans after a job shock

• Making irreversible decisions just to “stop the pain”

Fear compresses time.

It makes us trade long-term clarity for short-term relief.

That scene reminded me why most financial mistakes are not analytical errors.

They are emotional ones.

4. Jaskirat’s Past: When the Film Explains the Behaviour

The Scene That Reframed Everything

When the film reveals Hamza’s real identity as Jaskirat Singh Rangi, recruited from prison by Ajay Sanyal (R. Madhavan), something important happens.

The story doesn’t just move forward—it moves backward.

Suddenly:

• His risk appetite makes sense

• His moral conflict feels heavier

• His attachment and betrayal carry deeper meaning

The past wasn’t decoration.

It was the engine.

Why This Matters Far Beyond Cinema

In financial planning, numbers never tell the full story.

Behind every money habit is a history:

• Scarcity

• Sudden loss

• Early success

• Betrayal or failure

Unless that past is acknowledged, no financial plan truly works.

The film handled this revelation quietly—and it reinforced something I deeply believe:

You cannot change outcomes without understanding origins.

5. The Aftermath with Yaalina: Freedom Without Celebration

The Scene That Felt Most Real

After the mission’s major turning point, the film refuses to give us a victory lap.

Instead, we see Hamza emotionally fractured, haunted by visions of Rehman, and finally breaking down in front of Yaalina (Sara Arjun).

There is no triumph here.

Only consequence.

The mission may be “successful,” but the cost is visible, personal, and permanent.

The Final Financial Truth for Me

People often talk about financial freedom as if it is a finish line.

The film shows something far more honest.

Freedom is not escape.

It is ownership.

Ownership of choices.

Ownership of costs.

Ownership of consequences.

Real financial clarity feels like that scene:

Quiet. Heavy. Honest. Grounded.

Driving Back Home, Thinking About Life (Not the Film)

By the time I reached home, Dhurandhar had stopped being a spy thriller in my mind.

It had become a reminder of:

• Families surviving instead of planning

• Conversations avoided in the name of peace

• Fear making irreversible decisions

• The past silently shaping the future

Good films entertain you.

Rare films make you introspect.

And this one reminded me—very humanly—why financial planning is not about chasing returns, but about designing life with clarity, courage, and responsibility.

Author’s Note & Disclaimer

The reflections and parallels illustrated in this piece are purely my personal interpretation of the film Dhurandhar, viewed through the lens of my work and lived experience as a financial planner.

This is not a critique, analysis, or official explanation of the film’s intent, characters, or storyline. The scenes referenced are used as contextual anchors to express how certain moments emotionally resonated with me and triggered reflections on real-life financial behaviour, decision-making, and responsibility.

While care has been taken to stay close to the film’s actual emotional beats, the parallels drawn here are reflective and interpretive, not definitive or prescriptive. Think of this as a credible, human retelling of what the film evoked in me, rather than a factual plot breakdown or a Wikipedia-style summary.

All financial observations shared are illustrative in nature, based on my professional perspective, and should not be construed as specific financial advice.

This piece is best read as what it truly is:

A financial planner processing a film on the drive back home.

Disclaimer: The views expressed are for educational purposes only and do not constitute financial, investment, tax, or legal advice. Please consult qualified professionals before making decisions. Mutual fund investments are subject to market risks.

👉 Full Disclaimer | Disclosures | Terms of Use

| 👉Join my FAN page at: | facebook.com/CFPTareshBhatia |

| 👉Follow on Facebook: | facebook.com/TareshBhatiaCFPro |

| 👉Follow me on Instagram: | instagram.com/tareshbhatiacfp |

| 👉Follow me on Threads: | threads.net/@tareshbhatiacfp |

| 👉Follow me on Twitter: | twitter.com/tareshbhatiacfp |

| 👉Follow me on LinkedIn: | linkedin.com/in/tareshbhatiacfp |

| 👉Visit Website: | tareshbhatia.com |

| 👉Read Blog: | blog.tareshbhatia.com |

| 👉Buy my Book: | pages.razorpay.com/BookTRP |

| 👉Join me on Telegram: | t.me/+v0ewUJQU0wowN2Jl |

| 👉YouTube Channel: | youtube.com/@Taresh-Bhatia |

| 👉Subscribe: | tinyurl.com/SubscTB |

| 👉Join my Academy: | therichnessacademy.com |

| 👉Complimentary Session-Limited Offer: | learn.therichnessacademy.com/web/checkout/686f9d1203ac6c6374689439 |

| 👉WhatsApp message directly: | wa.me/919810127906 |

| 👉Get Ebook: | tinyurl.com/TenEbook |

The author of this article, Taresh Bhatia, is a Certified Financial Planner® and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2025: All Rights Reserved. Taresh Bhatia. Certified Financial Planner®

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here