Introduction:

Financial freedom is a buzzword thrown around a lot, but what does it really mean? And how much money do you need to achieve it? The truth is, it’s not about a specific number; it’s about having a clear financial plan and the habits to support it.

7 Facts:

1. Financial Freedom ≠ Money: Money is a tool, not a destination. Financial freedom is about having the freedom to pursue your passions and live life on your own terms.

2. Financial Freedom is a Journey: It’s not a one-time achievement; it’s a continuous process of planning, managing, and growing your finances.

3. Small Steps Lead to Big Results: Don’t get overwhelmed by the big picture. Start with small, habitable changes like tracking expenses, budgeting, and saving.

4. Debt is the Enemy: Avoid debt like the plague. It’s an anchor that drags you down and hinders your progress towards financial freedom.

5. Invest in Yourself: The best investment you can make is in yourself. Learn new skills, pursue your passions, and grow your earning potential.

6. Financial Freedom is Bliss: It’s not just about material possessions; it’s about peace of mind, freedom from stress, and the ability to live life to the fullest.

7. It’s Never Too Late: No matter your age or income level, you can start your journey towards financial freedom today.

5 Myths:

1. You need a lot of money: You don’t need millions to be financially free. It’s about living within your means and saving consistently.

2. Financial freedom is all about early retirement: While early retirement is an option, financial freedom is more about having choices.

3. Financial freedom means sacrificing everything: You can still enjoy your life while being financially responsible. It’s about finding a balance and making conscious choices.

4. Investing is risky and complicated: There are plenty of safe and accessible investment options for everyone, even beginners.

5. Financial freedom is a solo journey: Don’t be afraid to seek help and support from financial advisors, communities, and mentors.

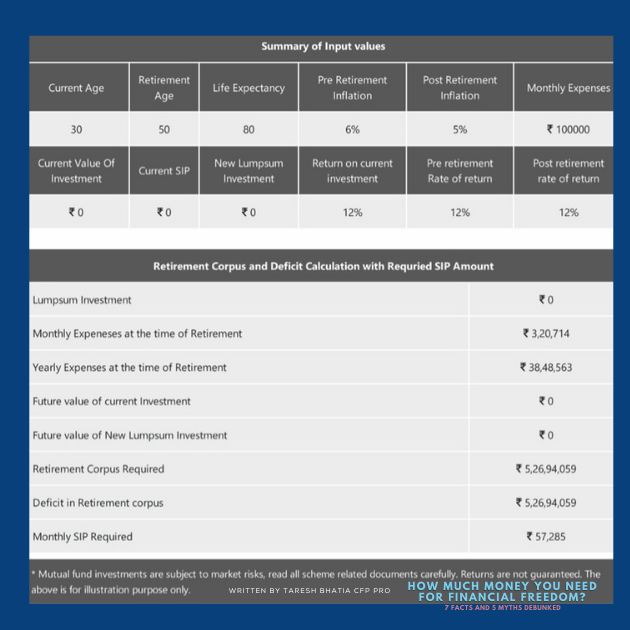

Let me explain with the help of an Example: (refer to the illustration given)

Mr. X’s Journey to Financial Freedom:

Imagine Mr X, a 30-year-old Delhi resident with a wife, two kids, and a monthly income of Rs. 2 lakhs. He dreams of financial freedom in 20 years, free from the paycheck-to-paycheck grind. Let’s see how much he needs and how he can achieve it.

The Magic Number: Rs. 5.5 Crores?

Mr. X’s goal is to secure a monthly income of Rs. 3.2 lakhs (adjusted for inflation) from age 50 to 80. Using a financial freedom calculator, we estimate he needs roughly Rs. 5.5 crores. This might seem daunting, but it’s achievable with the right plan and dedication.

The Path Forward:

Track and Analyze: Mr. X needs to understand his spending habits. Tracking expenses for a few months will reveal areas where he can cut back and save more.

Budget and Prioritize: Create a realistic budget, allocating for essentials, savings, and debt repayment. Prioritize needs over wants and avoid unnecessary spending.

Debt-Free Freedom: Debt is a significant roadblock. Mr. X should aggressively pay down debt to free up future income for his financial freedom fund.

Investment Power: Invest a portion of his savings in a diversified portfolio of [Disclaimer: Not a financial advisor, always consult a professional for personalized investment strategies] equity mutual funds to benefit from compound interest and grow his wealth over time.

Reaching the Summit: Rs. 57,285 per Month:

To achieve his target of Rs. 5.5 crores, Mr X needs to start investing in a good equity mutual fund for a monthly amount of Rs. 57,285. This aggressive approach requires expert guidance and regular reviews (annually or more frequently) to ensure it aligns with his risk tolerance and market conditions.

Remember:

Financial freedom is a marathon, not a sprint. Consistency and discipline are crucial.

Professional guidance from financial advisors can help tailor a strategy for your unique situation.

Build an emergency fund to handle unexpected events without derailing your progress.

Mr. X’s success story is within his grasp. By taking control of his finances today, he can build a future of freedom and security for himself and his family.

Call to Action:

Ready to take the first step towards financial freedom? Download our free financial freedom eBook for more insights, and start your journey today!

- Start by creating a financial plan: It doesn’t have to be fancy, just a simple roadmap for your goals.

- Track your expenses: Understanding where your money goes is the first step to taking control.

- Build an emergency fund: Having a safety net will give you peace of mind and prevent debt in unexpected situations.

- Invest in your future: Start small, but make it a habit. Compound interest is your friend!

- Embrace the journey: Financial freedom is a marathon, not a sprint. Celebrate your progress and learn from your setbacks.

Conclusion:

Financial freedom is not a pipe dream; it’s an achievable goal for anyone willing to put in the effort. By changing your mindset, developing healthy financial habits, and taking consistent action, you can build a life of freedom and fulfilment.

Remember, financial freedom is not about how much money you make; it’s about how you manage it. Start today and take control of your financial future!

Together, let’s start a financial revolution in India!

Disclaimer: This blog post and any investment proposals or information contained within are for informational purposes only and should not be construed as financial advice. The views and opinions expressed are solely those of the author and do not necessarily reflect the views of any affiliated organizations or entities.

Investment Risk: Investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. The assumed rates of return used in any illustrations are for informational purposes only and should not be relied upon as guarantees of future results. Mutual fund investments are subject to market risks, and investors may not get back the amount invested.

Professional Advice: Readers are advised to consult with a qualified financial advisor before making any investment decisions. This advisor can assess your individual circumstances and risk tolerance to create a personalized financial plan that aligns with your goals.

Qualifications and Credentials: While the author, Taresh Bhatia, holds the CERTIFIED FINANCIAL PLANNER PRO™ designation and is the author of an Amazon best-seller, this does not guarantee the success of any investment strategies or recommendations. The CFP® designation is a professional certification, not a guarantee of expertise or investment performance. He can be reached at taresh@taresh.in

Third-Party Links: Any links provided within this blog post are for informational purposes only and do not constitute endorsements or recommendations. Readers are advised to conduct their own research and due diligence before following any external links.

Copyright and Intellectual Property: ©️2023 Taresh Bhatia. All rights reserved. Unauthorized use or reproduction of this content without express written permission is prohibited.

Note:

Link: https://taresh.ck.page/ffreedom

The author of this article is Taresh Bhatia, a Financial Freedom Specialist, qualified as a CERTIFIED FINANCIAL PLANNER PRO who has authored an Amazon best seller-“The Richness Principles”. He can be reached at taresh@tareshbhatia.com

©️2024: All Rights Reserved. Taresh Bhatia

Subscribe Now for Upcoming Blogs!