Introduction

How market timing can undermine your mutual fund investments. The temptation to time the market is strong, especially during volatile periods. However, this approach often leads to disappointment and missed opportunities. For instance, consider the case of [famous investor’s name], who tried to time the market during the [specific market event]. Despite their expertise, they were unable to predict the market’s movements accurately, resulting in significant losses. In the world of equity markets, every day is a contest between buyers and sellers. On days when major indices plummet, this contest becomes particularly intense, leading to impulsive decisions that often result in regret.

What Happened on 3rd-4th June?

In early June 2024, mutual fund investors experienced a significant incident that underscored the challenges of market timing. On June 3rd and 4th, equity markets saw substantial volatility, with major indices experiencing dramatic swings. This was due to [specific market event or economic factor]. Many investors attempted to capitalize on the falling prices by placing buy orders to secure lower Net Asset Values (NAVs) for their mutual fund investments. However, numerous orders were delayed due to system glitches, resulting in higher NAVs on the following day. This event highlighted the inherent difficulties and risks associated with trying to time the market, primarily through mutual fund investments.

Why Market Timing Can Undermine Your Mutual Fund Investments

The temptation to time the market is strong, especially during volatile periods like the one seen in early June 2024. Investors rushed to buy at what they perceived to be the lowest prices, hoping to capitalize on a market rebound. However, as the June 3rd and 4th incidents, which were characterized by [specific market conditions], demonstrated, technical issues and the inherent delays in NAV calculations often thwart these attempts. This incident serves as a stark reminder that mutual funds are not designed for rapid-action trading.

The Complexity of Online Investing

Investing in mutual funds online involves a complex digital ecosystem. On June 4th, this system experienced slowdowns, leading to delayed transactions and frustrated investors. Such delays highlight the long-term nature of mutual fund investments, as the system is not equipped for the rapid trades that market timing demands. The volatility that day and the technical glitches emphasized that mutual funds are meant for patient, long-term investing rather than quick, speculative trades.

Why It Is Not Prudent to Try to Time the Market

Timing the market requires predicting both the right time to enter and exit, which is incredibly difficult even for seasoned investors. The June 3rd and 4th incidents showed how unpredictable and volatile the markets can be, making it nearly impossible to catch the exact bottom or top. Mutual fund investors who try to time the market often end up buying high and selling low, the exact opposite of a profitable strategy.

How Mutual Fund NAVs Do not Adjust to Help Investors Time the Market

The Net Asset Value (NAV) of mutual funds is a crucial factor in mutual fund investing. It is calculated at the end of each trading day based on the closing prices of the underlying securities. In simpler terms, it represents the value of each share of the mutual fund. As seen during the June incident, this means that the NAV you get is always the closing NAV of that day, not the real-time price. Investors who placed their buy orders on June 3rd hoped for a lower NAV, but the delays caused them to receive a higher NAV on June 4th. This delay makes it impossible to time the market accurately through mutual funds.

The Psychological Boost and Ultimate Reality

While getting the absolute lowest NAV might provide a psychological boost, it is ultimately meaningless in the grand scheme of long-term investing. The investors who genuinely benefit are those who can remain calm and strategic—buying when prices are depressed but holding firm through volatility. In this context, system glitches that prevent impulsive trading may sometimes be a blessing in disguise.

Why Mutual Fund Investment is Not a Game of Timing

Mutual fund investments are designed to grow over time, benefiting from the compounding effect of reinvested earnings. The June incident demonstrated the risks of trying to exploit short-term market movements. Instead, mutual fund investing relies on consistent investment and staying invested through market cycles. This approach provides a sense of security, helping investors ride out volatility and focus on the overall growth of their portfolio.

Why It Is Not Prudent to Try to Time the Market

Timing the market requires predicting both the right time to enter and exit, which is incredibly difficult even for seasoned investors. The volatility of the markets means that any perceived pattern can quickly change, leading to losses. The June 3rd and 4th incidents, which were characterized by [specific market conditions], showed how unpredictable and volatile the markets can be, making it nearly impossible to catch the exact bottom or top. Mutual fund investors who try to time the market often end up buying high and selling low, the exact opposite of a profitable strategy. The short-term fluctuations are part of the market’s natural ebb and flow and should not dictate investment decisions.

The Temptation of Market Timing

In the heat of market downturns, some investors see an opportunity to buy at extremely low prices, hoping to capitalize on the market’s recovery. On particularly volatile days, many investors rush to place their buy orders on online apps, aiming to catch the day’s low NAVs. However, system glitches can delay transactions, resulting in investors getting higher NAVs the following day. This incident underscores a critical point: Mutual funds are not designed for rapid action trading.

The Myth of Perfect Timing

The idea of perfect market timing is a myth. Even professional traders with access to advanced technology and real-time data find it challenging to predict market movements consistently. For retail investors, the task is even more daunting.

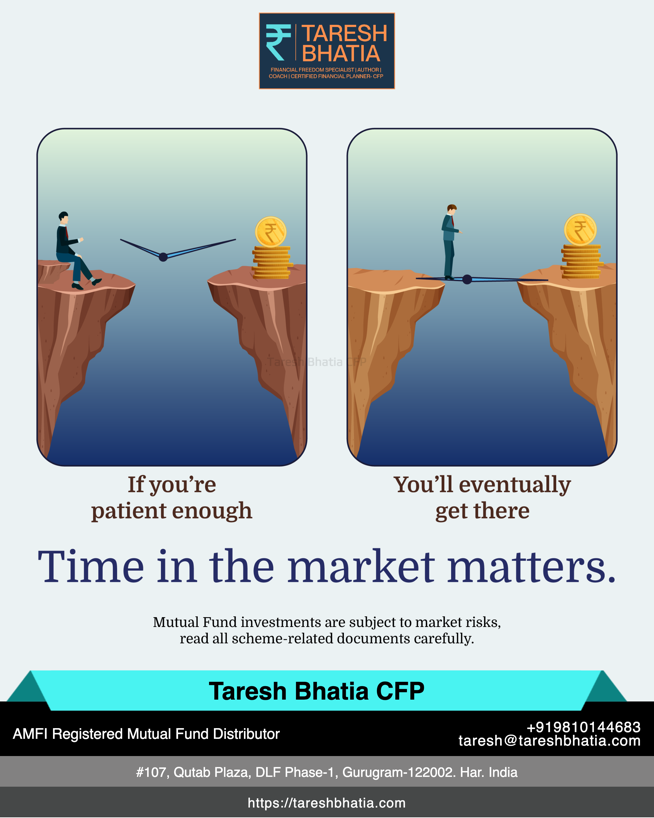

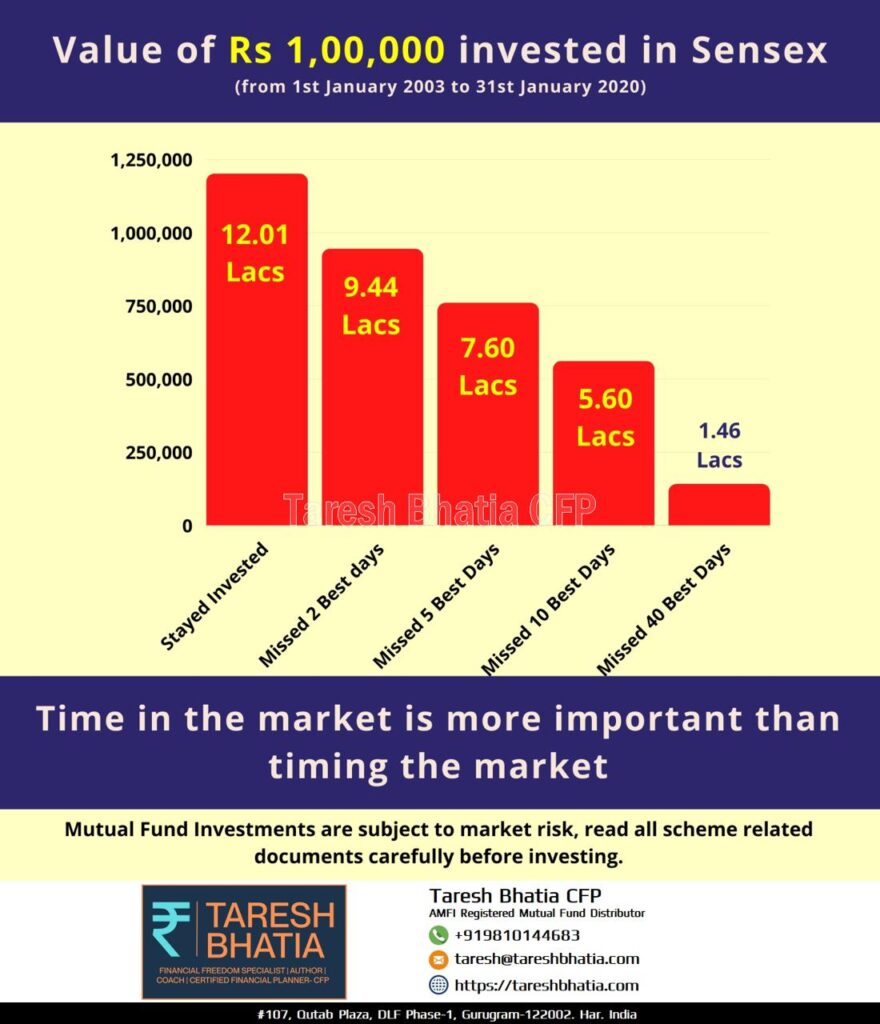

Rather than striving for perfect timing, investors should focus on time in the market. Historical data shows that staying invested through market cycles can lead to better long-term returns than attempting to time the market. This realization can be enlightening, as it underscores the futility of market timing. Consistent investment and patience are key to achieving financial success.

Why Prudent Mutual Fund Investors Remain Calm During Ups and Downs

Prudent mutual fund investors understand that market volatility is a natural part of investing. They maintain a long-term perspective and adhere to their investment strategy regardless of market conditions. The June 3rd and 4th events, which were characterized by [specific market conditions], highlighted the importance of staying calm and not reacting to short-term fluctuations. Successful investors know that the key to long-term success is not timing the market but spending time in it.

The Benefits of a Buy-and-Hold Strategy

A buy-and-hold strategy, where investors remain invested regardless of market conditions, has historically outperformed attempts at market timing. This approach leverages the power of compounding, where the earnings on investments generate additional earnings over time. By staying invested, mutual fund investors can benefit from the market’s long-term growth despite short-term volatility. This strategy is further bolstered by the confidence in professional management, who navigate the market on behalf of the investors.

The Role of Systematic Investment Plans (SIPs)

Systematic Investment Plans (SIPs) offer a structured way to invest in mutual funds. By investing a fixed amount at regular intervals, investors can benefit from rupee cost averaging, reducing the average cost per unit over time. The June incident underscored the importance of SIPs in maintaining a disciplined approach to investing, helping investors avoid the pitfalls of market timing.

SIPs also instil financial discipline by encouraging regular investments. This approach helps investors avoid the temptation of market timing and ensures that they remain invested through market cycles. Over the long term, SIPs can help build significant wealth by leveraging the power of compounding.

The Importance of Asset Allocation

Asset allocation is a critical component of a successful investment strategy. By diversifying investments across different asset classes, such as equities, bonds, and cash, investors can manage risk and achieve a balanced portfolio. The June incident highlighted the need for a well-diversified portfolio to cushion the impact of market volatility and provide more stable returns over the long term.

Staying the Course Through Market Volatility

Market volatility, like that experienced in early June, is an inherent part of investing. Rather than reacting to short-term fluctuations, mutual fund investors should focus on their long-term financial goals. Staying the course through market ups and downs requires patience, discipline, and a clear understanding of one’s investment strategy.

By maintaining a long-term perspective, investors can avoid the pitfalls of emotional decision-making and benefit from the market’s long-term growth potential. This approach requires confidence in the investment process and a commitment to staying invested through market cycles.

The Impact of Transaction Costs

Frequent trading to time the market can lead to significant transaction costs, including brokerage fees, taxes, and other charges. These costs can erode the potential gains from market timing and reduce the overall return on investment. Additionally, high turnover in a portfolio can trigger capital gains taxes, further diminishing returns.

By adopting a long-term investment strategy and minimizing trading activity, investors can reduce transaction costs and maximize their returns. Staying invested and allowing investments to grow over time can lead to better financial outcomes.

The Psychological Impact of Market Timing

Attempting to time the market can lead to significant psychological stress. The fear of missing out on potential gains and the anxiety of potential losses can drive impulsive decision-making. June 3rd and 4th events demonstrated how emotional reactions to market volatility can lead to poor investment decisions. By contrast, a disciplined investment approach, focused on long-term goals and regular investments, can reduce emotional stress.

Mutual fund investing should be approached with a clear understanding of one’s financial goals, risk tolerance, and investment horizon. A well-diversified portfolio, appropriate asset allocation, and regular investments form the cornerstone of a sound investment strategy. Investors should focus on these fundamentals rather than attempting to predict market movements.

One of the main advantages of mutual funds is professional management. Fund managers are equipped with the expertise and resources to navigate market fluctuations and make informed investment decisions. Relying on their expertise, rather than attempting to outguess the market, can lead to more stable and consistent returns.

Also read: How India’s Journey Towards Fiscal Stability in 2024 Impacts Mutual Fund Investors

Building a Resilient Portfolio

A resilient portfolio can withstand market volatility and deliver stable returns over the long term. Diversification, asset allocation, and regular investments are essential components of a resilient portfolio. By spreading investments across different asset classes and sectors, investors can reduce risk and enhance the stability of their portfolios.

Rebalancing the portfolio periodically is also important to maintain the desired asset allocation. As market conditions change, certain assets may outperform or underperform, leading to an imbalance in the portfolio. Rebalancing ensures that the portfolio remains aligned with the investor’s financial goals and risk tolerance.

The Power of Compounding

Compounding is one of the most powerful forces in investing. It refers to the process where the earnings on investments generate additional earnings over time. The longer an investor stays invested, the greater the compounding effect.

Staying invested through market cycles allows mutual fund investors to benefit from compounding. By reinvesting dividends and capital gains, investors can accelerate the growth of their investments. Over the long term, compounding can lead to significant wealth accumulation.

The Importance of Financial Discipline

Financial discipline is crucial for successful investing. This involves setting clear financial goals, creating a well-defined investment strategy, and sticking to the plan despite market fluctuations. It is also important to regularly review and adjust the investment strategy based on changing financial goals and market conditions.

Investors should avoid making decisions based on short-term market movements and focus on their long-term financial objectives. By maintaining financial discipline, investors can navigate market volatility and achieve their investment goals.

The Long-Term Perspective

Equity-based mutual funds are intended for years and decades of investment. On this scale, the movement of one day is insignificant. Even if one believes otherwise, it is likely that an individual needs more cash to invest in a single day to make a meaningful difference. The urge to catch the market’s bottom or top tick is understandable but often futile in practice.

Even professional traders with cutting-edge technology find it challenging to precisely time their entries and exits. For retail mutual fund investors, this task becomes even more daunting. A much sounder approach is to have a disciplined investment plan, adhere to asset allocation based on personal goals and risk tolerance, and ignore the noise of daily market fluctuations.

The Value of Professional Advice

Working with a financial advisor can provide valuable guidance and support for mutual fund investors. A financial advisor can help investors develop a comprehensive investment strategy based on their financial goals, risk tolerance, and time horizon. Professional advice can also help investors stay disciplined and focused during periods of market volatility, avoiding the temptation to make impulsive decisions based on short-term market movements.

The Role of Professional Fund Managers

One key benefit of investing in mutual funds is access to professional fund management. Fund managers have the expertise, resources, and experience to navigate complex market conditions and make informed investment decisions. They conduct thorough research, analyze market trends, and strategically allocate assets to optimize returns while managing risk.

Leveraging the skills of professional fund managers can be a significant advantage for individual investors. Rather than attempting to time the market themselves, investors can rely on fund managers’ expertise to manage their investments effectively.

Conclusion

The events of June 3rd and 4th, 2024, serve as a powerful reminder of the challenges and risks associated with market timing. In the world of mutual fund investing, patience and discipline are key. Trying to catch the bottom of a falling market is a risky endeavour that often leads to disappointment. Instead, focus on maintaining a sound investment strategy, adhere to your asset allocation, and stay the course through market ups and downs. By doing so, you will be better positioned to achieve your long-term financial goals and avoid the pitfalls of impulsive market timing.

Ultimately, the key to successful investing is not timing the market but time in the market. By staying invested and maintaining a disciplined investment approach, mutual fund investors can achieve their financial goals and build wealth over time.

Disclaimer

This guide is intended for general informational purposes only and should not be construed as professional tax advice. Tax laws and regulations are subject to change, and individuals should consult with a qualified tax professional or Chartered Accountant for personalized guidance. The author and publisher do not assume any liability for any errors or omissions in the content. The information provided in this video is for general informational purposes only and reflects the latest updates on income tax slabs in India as of the current fiscal year. Readers and Viewers are advised to consult with a qualified tax professional for personalized advice and to verify the latest tax regulations.

The author of this article, Taresh Bhatia, is a Certified Financial Planner® and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2025: All Rights Reserved. Taresh Bhatia. Certified Financial Planner®

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here