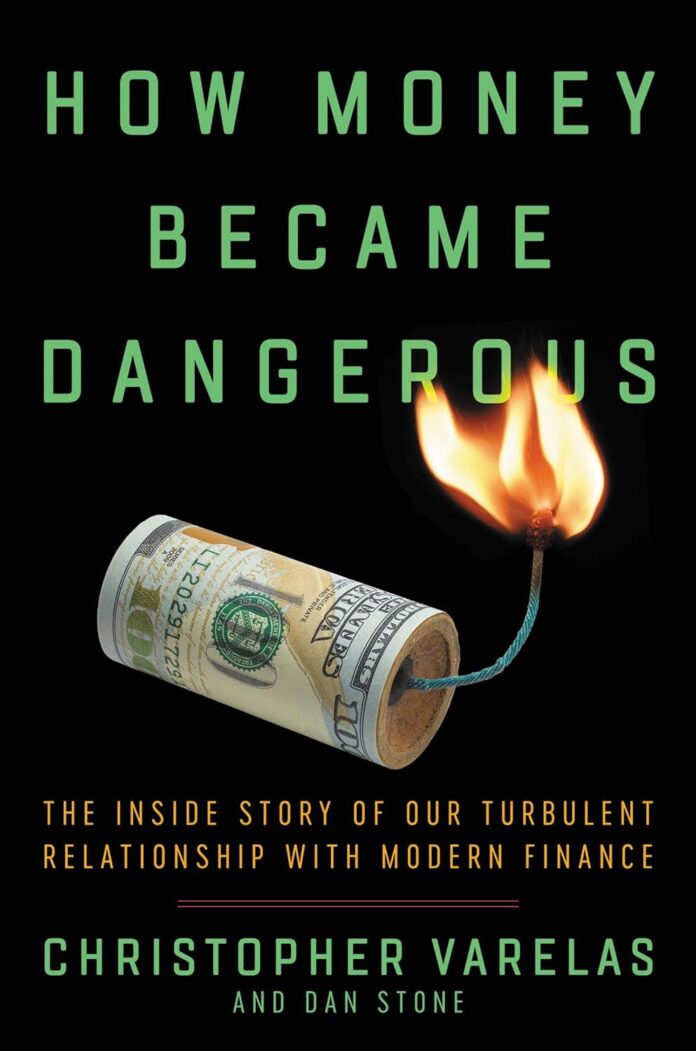

10 Practical Lessons from “How Money Became Dangerous” by Christopher Varelas

As a financial coach and mentor, I’m always on the lookout for valuable insights that can help my clients navigate the often complex and turbulent world of modern finance. Christopher Varelas’s book, *How Money Became Dangerous: The Inside Story of Our Turbulent Relationship with Modern Finance*, offers a wealth of practical advice that resonates deeply with the principles I advocate. Here are ten key takeaways from the book that can help you achieve financial security and build lasting wealth.

1. Question the Financial System

Understanding the financial system’s intricacies is crucial. The history of money, the role of banks, and the impact of financial institutions shape our financial landscape. The financial system, in its modern form, is a web of complex institutions and mechanisms designed to manage money, credit, and investment. By developing a critical understanding of these elements, you can make more informed decisions.

For instance, knowing how fractional-reserve banking works can help you understand the risks of bank runs and the importance of maintaining liquidity. Similarly, understanding the role of central banks can provide insight into monetary policy and its impact on inflation and interest rates. Knowledge of the system’s inner workings helps you identify potential risks and benefits, enabling you to navigate the financial world with confidence. This understanding also empowers you to advocate for fairer, more transparent financial practices.

2. Beware of Short-Term Thinking

In today’s fast-paced financial environment, short-term gains often overshadow long-term stability. It’s tempting to chase quick returns, but such strategies can lead to instability. The lure of immediate profits can often blind investors to the risks involved. Short-term thinking is prevalent in stock markets where day trading and speculation can lead to significant volatility.

Instead, prioritize long-term planning. Building a robust financial future requires patience and a focus on sustainable growth rather than immediate rewards. This approach not only secures your financial health but also provides peace of mind. Long-term investments, such as retirement accounts or real estate, typically offer more stability and security. These investments benefit from compounding interest and have the potential to grow significantly over time, providing a solid foundation for your financial future.

3. Debt Can Be a Double-Edged Sword

Debt, when used strategically, can be a powerful tool for financial growth. For example, taking out a mortgage to buy a home can be a good investment if property values increase over time. Similarly, student loans can be considered an investment in your future earning potential. However, debt also carries significant risks. Credit card debt, payday loans, and other high-interest borrowings can quickly spiral out of control, leading to financial instability.

Understanding the nature of debt and its potential consequences is essential. Only borrow what you can comfortably repay, and always consider the long-term implications of taking on debt. Responsible debt management is key to maintaining financial stability and avoiding the pitfalls of over-leverage. It’s also important to differentiate between good debt (debt that can generate income or increase value) and bad debt (debt that does not improve your financial position). By using debt wisely, you can leverage opportunities for growth without jeopardizing your financial security.

4. Diversification is Key

Diversification is a fundamental principle of sound investing. By spreading your investments across different asset classes—such as stocks, bonds, and real estate—you minimize risk and enhance the potential for long-term returns. Diversification helps protect your portfolio from the volatility of any single investment and reduces the impact of market fluctuations.

For example, if the stock market experiences a downturn, investments in bonds or real estate might remain stable or even increase in value, balancing the overall performance of your portfolio. This strategy protects you from the volatility of any single investment and helps you build a more resilient portfolio. Additionally, diversification can include geographic diversification (investing in international markets) and sector diversification (investing in different industries). This broad approach ensures that your investments are not overly concentrated in one area, further reducing risk and increasing potential returns.

5. Beware of Financial Hype

The financial world is rife with marketing and hype. Every day, we are bombarded with advertisements and promotions for various financial products and investment opportunities. It’s essential to distinguish between sound financial advice and get-rich-quick schemes. Always do your own research and seek professional guidance before making investment decisions.

For instance, during the dot-com bubble, many investors were lured into tech stocks by the promise of rapid wealth, only to suffer significant losses when the bubble burst. Similarly, the cryptocurrency market has seen its share of hype and volatility. By critically evaluating the information you encounter, you can avoid costly mistakes and make choices that align with your financial goals. Look for investments with strong fundamentals and a track record of performance rather than being swayed by flashy marketing or unrealistic promises. Remember, if something sounds too good to be true, it probably is.

6. Focus on Value, Not Just Growth

High growth potential does not always equate to a good investment. It’s crucial to focus on the underlying value and long-term sustainability of an investment. Evaluate the fundamentals and ensure that the growth prospects are based on solid financial ground.

For example, during the housing bubble, many investors were drawn to real estate due to rapidly rising prices, ignoring the underlying risks. When the bubble burst, many were left with properties worth less than their purchase price. This approach helps you build a portfolio that can weather market fluctuations and deliver consistent returns over time. Focus on companies with strong balance sheets, reliable earnings, and sustainable business models. By prioritizing value, you can invest in assets that offer long-term growth and stability.

7. Understand the Risks of Financial Engineering

Complex financial instruments, such as derivatives, collateralized debt obligations (CDOs), and credit default swaps (CDS), can be both enticing and dangerous. These products can offer high returns but also carry significant risks. Before investing in products you don’t fully understand, take the time to educate yourself about the associated risks.

The 2008 financial crisis highlighted the dangers of these instruments, as many investors and institutions suffered massive losses due to their exposure to toxic assets. Financial engineering can lead to significant gains, but it can also result in substantial losses if not approached with caution. Being informed empowers you to make smarter investment decisions. Always ensure you fully understand how a financial product works, its potential risks, and how it fits into your overall investment strategy before committing your money.

Also read: What “Mind over Money” Teaches About Behavioral Economics for Financial Wisdom and Richness

Financial Maestro" class="wp-image-889"/>

Financial Maestro" class="wp-image-889"/>8. Beware of Bubbles and Crashes

Financial markets are inherently volatile, with periods of exuberance followed by downturns. Recognizing the signs of market bubbles and preparing for potential crashes is vital for protecting your assets. Market bubbles occur when asset prices become inflated beyond their intrinsic value, driven by investor behavior rather than fundamental factors.

For example, the dot-com bubble and the housing bubble were characterized by irrational exuberance and speculative investing. Developing an exit strategy and staying vigilant can help you avoid getting caught in a market frenzy. This proactive approach helps safeguard your investments and ensures long-term financial stability. It’s important to stay informed about market conditions, economic indicators, and potential warning signs of a bubble. By doing so, you can take steps to protect your portfolio and mitigate losses during market downturns.

9. Building Wealth Takes Time and Discipline

Wealth-building is a long-term endeavor that requires patience and discipline. Avoid the allure of overnight success and stay committed to your financial plan. Consistent investing, prudent spending, and regular saving are the cornerstones of financial growth.

For example, contributing regularly to a retirement account, such as a 401(k) or IRA, allows you to benefit from compounding interest over time. Similarly, maintaining a budget and controlling discretionary spending helps you save and invest more effectively. By maintaining a disciplined approach, you can achieve your financial goals and enjoy the rewards of your efforts over time. Set realistic financial goals, create a plan to achieve them, and stay focused on your long-term objectives. Remember, building wealth is a marathon, not a sprint.

10. Financial Literacy Empowers You

Knowledge is power, especially in the realm of finance. The more you understand about money and financial systems, the better equipped you are to make informed decisions. Financial literacy involves understanding key concepts such as budgeting, saving, investing, and managing debt.

For example, knowing how to read financial statements and analyze investment performance can help you make smarter investment choices. Understanding credit scores and how they affect borrowing can help you manage debt more effectively. Invest in your financial education and stay updated on economic trends. This continuous learning process empowers you to navigate financial challenges and seize opportunities, ultimately leading to greater financial independence. Resources such as books, online courses, seminars, and financial advisors can provide valuable knowledge and insights to enhance your financial literacy. By staying informed and educated, you can confidently make decisions that support your financial well-being and long-term goals.

Conclusion

Christopher Varelas’s *How Money Became Dangerous* offers invaluable insights into the complexities of modern finance. By incorporating these ten practical lessons into your financial strategy, you can better navigate the turbulent financial landscape and build a secure, prosperous future.

Remember, financial success is not about quick wins but about making informed, disciplined decisions that lead to long-term stability and growth. Each of the ten lessons provides a foundation for sound financial management, helping you avoid common pitfalls and leverage opportunities for growth.

Whether it’s questioning the financial system, avoiding short-term thinking, managing debt responsibly, diversifying your investments, or focusing on financial literacy, each principle is a step towards achieving financial security and independence.

For those interested in delving deeper into these concepts, I highly recommend reading the book. It’s a compelling exploration of our relationship with money and finance, offering a perspective that is both enlightening and practical.

You can purchase the book here or get the audio version for free through Audible here. Investing in your financial knowledge today will pay dividends in the future. Happy reading and investing!

The author of this article, Taresh Bhatia, is a Certified Financial Planner and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2024: All Rights Reserved. Taresh Bhatia.

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here