Did your November salary suddenly look slimmer… even though your CTC on paper is exactly the same?

You’re not alone.

From 21 November 2025, India’s new labour codes have quietly changed the way your salary is structured, how your Provident Fund (PF) is calculated, and ultimately what lands in your bank account each month. For thousands of salaried professionals, this has meant a higher PF deduction and a lower in-hand salary—without much explanation from HR.

And naturally, my WhatsApp has been buzzing:

“Taresh, why is my salary lower? Is my company cheating me or is this some new government rule?”

As someone who lives and breathes personal finance, my mission is simple:

Financial Planning is the Real Wealth — Because a Plan is Greater Than a Salary and Planning is the New Earning.

So let me walk you through what has changed, why the much-talked-about “50% Basic Pay rule” matters, and how—if you play it right—this can actually strengthen your financial future rather than weaken it.

1. What Exactly Is This “50% Basic Pay” Rule?

First, the backdrop.

India has consolidated 29 old labour laws into four major Labour Codes:

- Code on Wages, 2019

- Code on Social Security, 2020

- Industrial Relations Code, 2020

- Occupational Safety, Health and Working Conditions (OSHWC) Code, 2020 (Press Information Bureau)

Key provisions of these codes have now been notified with effect from 21 November 2025, changing how wages, PF, gratuity and social security benefits are handled across the country. (Ministry of Labour & Employment)

For you and me as salaried individuals, the story boils down to one powerful question:

How is “wages” defined now—and how does that change my PF, my gratuity, and my take-home?

Under the Code on Wages, 2019 and the Code on Social Security, 2020, the government has introduced a uniform definition of “wages” for social-security purposes. (Ministry of Labour & Employment)

What Counts as “Wages” Now?

Under the new definition, “wages” include:

- Basic pay

- Dearness allowance (DA)

- Retaining allowance, if any

Several components are explicitly excluded, such as:

- House Rent Allowance (HRA)

- Conveyance allowance

- Overtime

- Bonus and commission

- Certain reimbursements

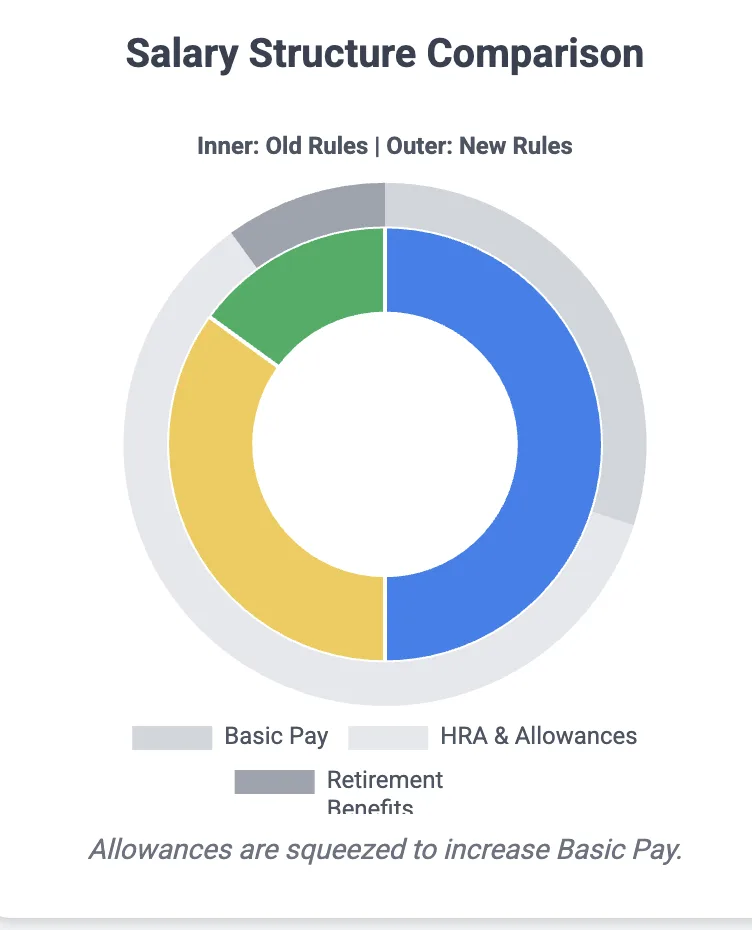

Here’s the critical twist:

All excluded items together (allowances, bonuses, etc.) cannot exceed 50% of your total remuneration.

If they do, the excess portion is added back into “wages” for calculating PF, gratuity and other social-security benefits. (Press Information Bureau)

In plain English:

- Basic + DA must now be at least 50% of your total pay for social security purposes.

- Earlier, many companies kept basic at 25–40% of CTC and loaded the rest into allowances (HRA, special allowance, etc.) to reduce PF and gratuity outgo.

- Now, that optimisation game is more or less over. Social security will be computed on at least 50% of your remuneration, no matter how colourful your payslip looks.

My expert macro view:

This is the government’s way of saying, “We want your retirement benefits to be based on a realistic income, not an artificially low basic salary.”

And as someone focused on designing financial roadmaps for Indian families, I actually see this as a structural nudge towards better long-term security.

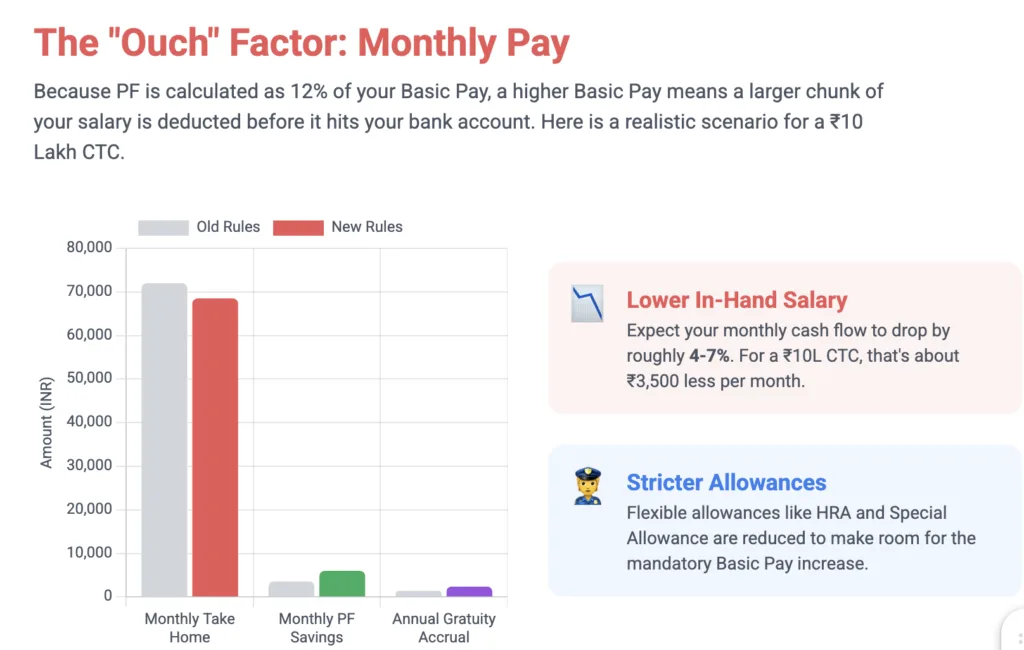

2. “Why Is My Salary Lower?” – The Immediate Shock on Take-Home

Let’s address the most emotional part first: the shock of a lower salary credit.

If your November or December salary dropped by a few thousand rupees, here’s what most likely happened behind the scenes:

- Your company revised your salary structure so that Basic + DA is now at least 50% of your pay.

- Because basic increased, your PF contribution (12% of basic) automatically went up.

- If gratuity is included in your CTC, your employer’s future gratuity liability has also increased, since gratuity is calculated on “wages” (this increased basic).

So yes, there is short-term “bad news”:

- For many mid to high-income employees, cash-in-hand has dropped by around 4% to 7%, because more of the CTC is now locked into PF and long-term benefits instead of flexible allowances.

My micro view (what you feel today):

- Your UPI spends feel tighter.

- EMIs, school fees, and monthly SIPs seem to compete harder for space.

- It feels like a pay cut—even when your CTC is unchanged.

My macro view (what this means for your life plan):

If we zoom out from one month to 15–20 years, this isn’t a pure negative. It’s a reallocation—from short-term consumption to long-term savings. That’s painful for lifestyle, but powerful for your future self.

This is where my core belief kicks in:

Financial Planning for every life stage — designing structured roadmaps for families, where every rupee has direction and purpose.

If you give this “extra PF” a purpose, it becomes a tool, not a nuisance.

3. The Good News: Higher PF, Higher Gratuity & Compulsory Wealth Creation

Let’s clear one misconception:

Your money hasn’t disappeared. It has just changed compartments.

Instead of sitting in your bank account (where it may get spent), it is now moving into:

- Your EPF account, and

- Your future gratuity.

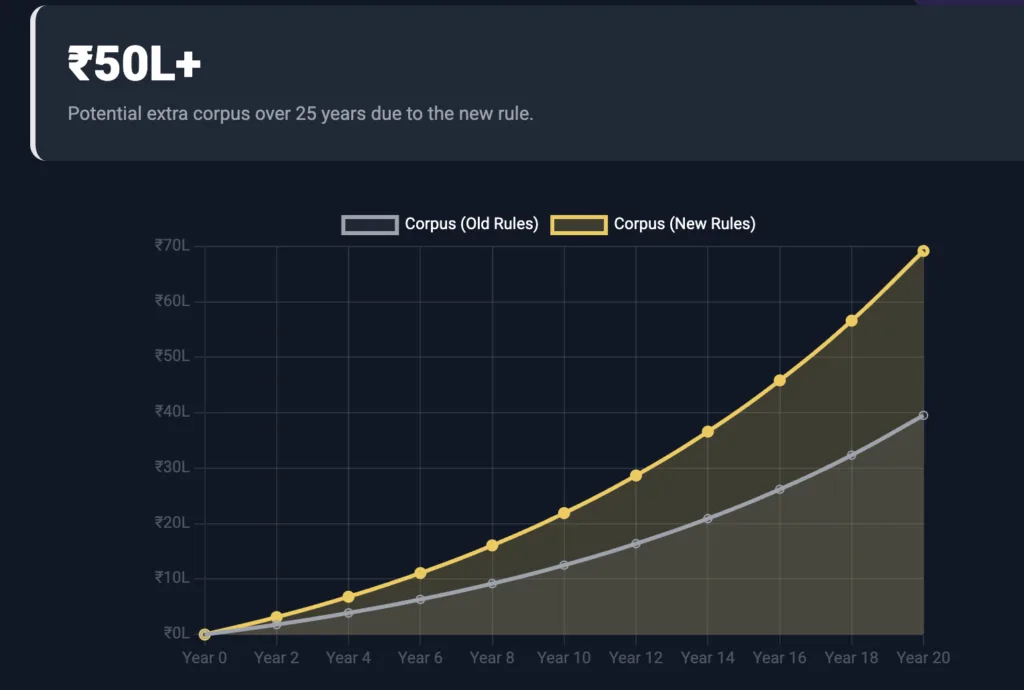

3.1 PF as a Forced Long-Term Saving

When basic pay increases, both your PF contribution and your employer’s contribution (each 12% of basic) go up.

That means:

- More money is flowing every month into your EPF,

- Earning a decent, relatively stable rate of return,

- With the magic of compounding working over 15–20 years.

For many families I work with, this boost in PF contributions alone can make their retirement corpus 1.5 to 2 times larger, particularly when they were under-saving earlier.

My expert comment:

Left to ourselves, most of us don’t voluntarily increase our retirement savings every time our salary goes up. These new rules essentially force you and your employer to put more aside for your future. It may not feel like a gift, but financially, it behaves like one.

3.2 Gratuity Becomes More Meaningful

Gratuity is linked directly to your “wages” (i.e., the new higher basic + DA).

So with a higher basic:

- Your gratuity payout—whenever you leave the company after completing 5 years—will also be higher.

And there’s a very important inclusion:

Fixed-term and contract employees become eligible for gratuity after just 1 year of service, unlike earlier, when many missed out due to the 5-year rule.

That means a much larger section of the workforce now gets a piece of the long-term benefit pie.

My macro comment:

For many mid-career professionals, gratuity is often the “forgotten asset” in their retirement planning. Now, with a stronger legal foundation and a clearer definition of wages, this becomes a serious building block in designing financial roadmaps for Indian families.

4. What Happens to PF Under These New Rules?

The PF law itself (Employees’ Provident Funds & Miscellaneous Provisions Act) isn’t being rewritten in terms of contribution rate. What’s changing is the base on which that number is calculated.

Key points to remember:

- PF rate remains 12% each for employee and employer.

- The statutory PF wage ceiling of ₹15,000/month for compulsory contributions still exists; PF beyond this is voluntary or policy-driven.

- Because the new “wages” definition enforces the 50% rule, if your company calculates PF on actual basic rather than just on ₹15,000, your PF base will rise if your basic was earlier less than 50% of CTC.

So:

- If your company always capped PF at ₹15,000, your PF impact may be smaller, though gratuity and other benefits still change.

- If your company uses full basic salary for PF (very common in MNCs, Big 4, IT, and larger Indian corporates), and your basic has now been pushed up to 50% of CTC, your PF contribution will increase significantly.

My expert lens:

This is where you should not just be a passive observer. Ask your HR: “Is PF calculated on ₹15,000 or on my actual basic?”

That one answer changes the entire picture for your long-term wealth.

5. FOUR real-life salary examples—₹6 lakh, ₹10 lakh, ₹25 lakh, and ₹60 lakh annual CTC—showing exactly how the new Labour Code’s 50% Basic Rule changes PF, take-home salary, and long-term retirement impact.

All examples assume:

- PF is calculated on actual basic pay (not capped at ₹15,000) — typical of large companies, MNCs, Big 4, IT services, startups, and many mid-sized firms.

- Basic increases from 40% to 50% of CTC to comply with the new rule.

- PF rate = 12% employee + 12% employer.

- We ignore tax for simplicity so that PF and take-home effect is clear.

5. Real-Life Style Examples: How the 50% Rule Changes Your PF and Take-Home

When the new Labour Code forces employers to raise Basic Pay to at least 50% of CTC, the PF base rises, which means:

- Higher PF deduction (your contribution)

- Higher employer contribution (free money)

- Lower take-home in the short term

- Much larger retirement corpus in the long run

Here is how it plays out across different income levels.

Example 1: CTC = ₹6,00,000 per year (₹50,000 per month)

OLD Structure (40% Basic)

- Basic = ₹20,000/month

- Employee PF (12%) = ₹2,400/month

- Employer PF (12%) = ₹2,400/month

- Total PF per month = ₹4,800

- Your in-hand reduces by = ₹2,400/month

NEW Structure (50% Basic)

- Basic = ₹25,000/month

- Employee PF (12%) = ₹3,000/month

- Employer PF (12%) = ₹3,000/month

- Total PF per month = ₹6,000

- Your in-hand now reduces by = ₹3,000/month

- Extra deduction per month = ₹600

Annual + Long-Term Impact

- Extra PF contributor (you + employer) = ₹600 × 2 × 12 = ₹14,400/year

- Over 20 years @8% return → ₹6–7 lakh additional EPF wealth

This income group feels the PF increase, but the forced savings help build retirement security.

Example 2: CTC = ₹10,00,000 per year (₹83,333 per month)

OLD Structure (40% Basic)

- Basic = ₹33,333/month

- Employee PF (12%) = ₹4,000/month

- Employer PF (12%) = ₹4,000/month

- Total PF per month = ₹8,000

NEW Structure (50% Basic)

- Basic = ₹41,666/month

- Employee PF (12%) = ₹5,000/month

- Employer PF (12%) = ₹5,000/month

- Total PF per month = ₹10,000

Difference

- Extra PF deduction (your share) = ₹1,000/month

- Annual extra PF (you + employer) = ₹24,000

- 20-year corpus impact → ₹24,000/year grows to ₹11–12 lakh.

For the ₹10 lakh bracket, this extra PF meaningfully boosts retirement savings, without hurting take-home too severely.

Example 3: CTC = ₹25,00,000 per year (₹2,08,333 per month)

OLD Structure (40% Basic)

- Basic = ₹83,333/month

- Employee PF (12%) = ₹10,000/month

- Employer PF (12%) = ₹10,000/month

- Total PF per month = ₹20,000

NEW Structure (50% Basic)

- Basic = ₹1,04,166/month

- Employee PF (12%) = ₹12,500/month

- Employer PF (12%) = ₹12,500/month

- Total PF per month = ₹25,000

Difference

- Extra PF deduction (your share) = ₹2,500/month

- Extra PF (you + employer) = ₹5,000/month

- Annual extra PF = ₹60,000

- 20-year wealth impact → Can generate ₹28–32 lakh extra EPF corpus.

Professionals in the ₹20–30 lakh band see a visible dip in take-home, but also dramatically higher long-term compounding.

Example 4: CTC = ₹60,00,000 per year (₹5,00,000 per month)

(Big 4 / Consulting / MNC example)

OLD Structure (40% Basic)

- Basic = ₹2,00,000/month

- Employee PF (12%) = ₹24,000/month

- Employer PF (12%) = ₹24,000/month

- Total PF per month = ₹48,000

NEW Structure (50% Basic)

- Basic = ₹2,50,000/month

- Employee PF (12%) = ₹30,000/month

- Employer PF (12%) = ₹30,000/month

- Total PF per month = ₹60,000

Difference

- Extra PF deduction = ₹6,000/month

- Total extra PF (you + employer) = ₹12,000/month

- Annual extra PF contribution = ₹1,44,000

- 20-year additional corpus = ₹60–70 lakh

For high-CTC roles, this impact is the strongest:

- Immediate: noticeable drop in take-home

- Long term: massive retirement benefit

This income bracket sees the largest boost to their lifelong wealth.

Summary Table (Quick View)

| Annual CTC | Old PF (Your Share) | New PF (Your Share) | Monthly Take-Home Drop | Extra Annual PF (You + Employer) | 20-Year Extra EPF Wealth |

| ₹6 lakh | ₹2,400 | ₹3,000 | ₹600 | ₹14,400 | ₹6–7 lakh |

| ₹10 lakh | ₹4,000 | ₹5,000 | ₹1,000 | ₹24,000 | ₹11–12 lakh |

| ₹25 lakh | ₹10,000 | ₹12,500 | ₹2,500 | ₹60,000 | ₹28–32 lakh |

| ₹60 lakh | ₹24,000 | ₹30,000 | ₹6,000 | ₹1,44,000 | ₹60–70 lakh |

Big 4 Professional in Gurugram (CTC ₹60 Lakh)

Let’s take a specific, high-CTC case which I see very often.

Profile:

- City: Gurugram

- Employer: Big 4 / large consulting firm

- Annual CTC: ₹60 lakh

- Bonus + allowances: about ₹15 lakh within that CTC

- PF is on actual basic, not capped at ₹15,000

5.1 Before the 50% Rule

Monthly CTC = ₹60,00,000 ÷ 12 = ₹5,00,000

A typical old structure:

- Basic = 40% of CTC → ₹2,00,000/month

- Allowances = 60% → ₹3,00,000/month

Disclaimer: The views expressed are for educational purposes only and do not constitute financial, investment, tax, or legal advice. Please consult qualified professionals before making decisions. Mutual fund investments are subject to market risks.

👉 Full Disclaimer | Disclosures | Terms of Use

| 👉Join my FAN page at: | facebook.com/CFPTareshBhatia |

| 👉Follow on Facebook: | facebook.com/TareshBhatiaCFPro |

| 👉Follow me on Instagram: | instagram.com/tareshbhatiacfp |

| 👉Follow me on Threads: | threads.net/@tareshbhatiacfp |

| 👉Follow me on Twitter: | twitter.com/tareshbhatiacfp |

| 👉Follow me on LinkedIn: | linkedin.com/in/tareshbhatiacfp |

| 👉Visit Website: | tareshbhatia.com |

| 👉Read Blog: | blog.tareshbhatia.com |

| 👉Buy my Book: | pages.razorpay.com/BookTRP |

| 👉Join me on Telegram: | t.me/+v0ewUJQU0wowN2Jl |

| 👉YouTube Channel: | youtube.com/@Taresh-Bhatia |

| 👉Subscribe: | tinyurl.com/SubscTB |

| 👉Join my Academy: | therichnessacademy.com |

| 👉Complimentary Session-Limited Offer: | learn.therichnessacademy.com/web/checkout/686f9d1203ac6c6374689439 |

| 👉WhatsApp message directly: | wa.me/919810127906 |

| 👉Get Ebook: | tinyurl.com/TenEbook |

The author of this article, Taresh Bhatia, is a Certified Financial Planner® and advocate for female empowerment. For more information and personalized financial guidance, please contact taresh@tareshbhatia.com

He has authored an Amazon best seller-“The Richness Principles”. He is the Coach and founder of The Richness Academy, an online coaching courses forum. This article serves educational purposes only and does not constitute financial advice. Consultation with a qualified financial professional is recommended before making any investment decisions. An educational purpose article only and not any advice whatsoever.

©️2025: All Rights Reserved. Taresh Bhatia. Certified Financial Planner®

Subscribe Now for Upcoming Blogs!

[convertkit form=6555951]

📢 Join free live webinar —

Couple Finance Formula™ Register here