Introduction:

Navigating the complexities of the tax system can be daunting, especially with the introduction of the new tax regime alongside the existing one. As taxpayers grapple with decisions on which regime to opt for, it’s crucial to understand the factors that can influence this choice. In this guide, we’ll delve into the key considerations individuals should ponder when deciding between the old and new tax regimes. From assessing deductions and exemptions to evaluating long-term financial implications, we’ll provide insights to help you make an informed decision that aligns with your financial goals and circumstances. Let’s explore the factors that should weigh into your decision-making process.

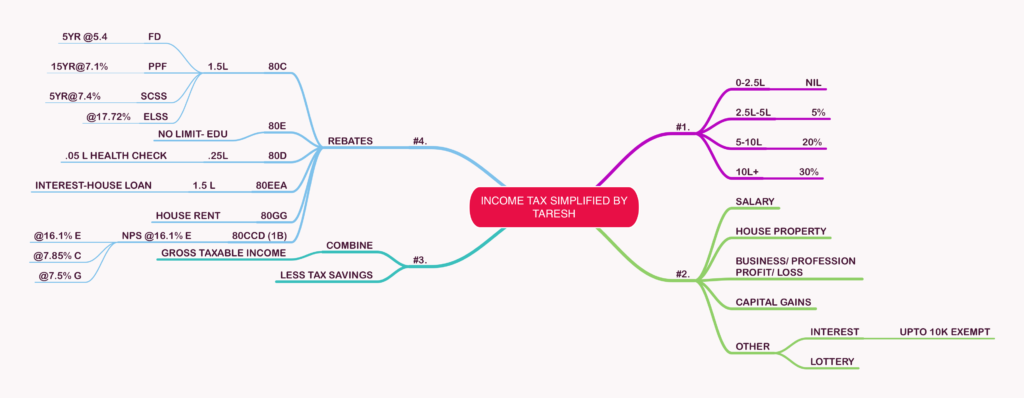

I have attempted to cover this topic in the following sections

1. Comparison between the old and new tax regimes

2. Eligibility criteria for choosing between the two regimes

3. Tax rebates and exemptions under the new tax regime

4. Deductions and exemptions not claimable under the new tax regime

5. Tax rates and slabs under the new tax regime

6. Impact of the new tax regime on taxpayers earning over Rs. 5 crore

7. Overview of Section 115BAC and its implications

8. Explanation of Section 10 exemptions in the new tax regime

9. Analysis of which tax regime is better for different income levels

10. Exemptions and deductions allowed in the new tax regime

11. Advantages and disadvantages of the old and new tax regimes

12. Factors to consider when choosing between the two tax regimes

As the financial landscape evolves, so do the avenues for tax optimization. For investors in the Indian mutual fund markets, the choice between the old and new tax regimes can significantly impact their financial strategies. In this article, we’ll delve into the nuances of both regimes, exploring their advantages and disadvantages to help you make informed decisions.

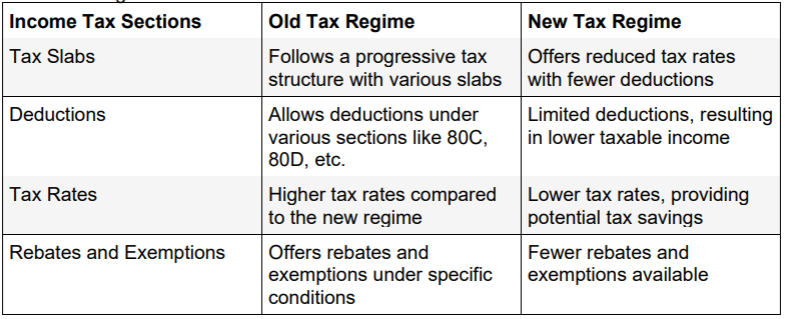

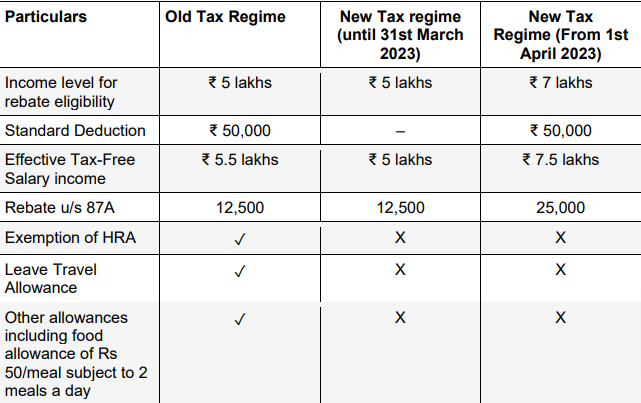

Old vs. New Tax Regime: A Comparative Analysis

One of the primary considerations for investors is determining which tax regime aligns better with their financial goals. Here’s a breakdown of the income tax sections available under both regimes:

The New Tax Regime: Friend or Foe

The introduction of the new tax regime has stirred a debate among taxpayers. While it offers reduced tax rates, it also limits deductions, which may not be favorable for everyone. Here’s a closer look:

Adversary for Some Taxpayers:

• Taxpayers who heavily rely on deductions to lower their taxable income may find the new regime less advantageous. Deductions under sections like 80C, 80D, and others play a crucial role in reducing tax liability, which is limited in the new regime.

• Individuals with significant investments in avenues eligible for deductions, such as EPF, PPF, life insurance premiums, etc., may not benefit as much from the reduced tax rates offered in the new regime.

Opportunity for Some Taxpayers:

• For individuals with relatively lower investments in deduction-eligible avenues, the new tax regime presents an opportunity for tax savings. The reduced tax rates can translate into more disposable income, enhancing their financial flexibility.

• Young professionals or those with fewer financial commitments may find the new regime appealing, as they may not have substantial deductions to avail themselves of in the first place.

Zero Tax Liability for Taxable Income up to Rs 5 Lakh

Under the new regime, taxpayers with a taxable income of up to Rs 5 lakh enjoy zero tax liability. This provision wasn’t available under the old regime, making the new regime particularly attractive for individuals with lower incomes.

Section 115BAC: Exploring the New Tax Regime-

The Budget 2020 introduces a new regime under section 115BAC giving individuals and HUF taxpayers an option to pay income tax at lower rates. The new tax regime system came in force from FY 2020-21 (AY 2021-22)

Section 115BAC introduces a new tax regime aimed at simplifying the tax structure and providing relief to taxpayers. It offers reduced tax rates but restricts the availability of deductions, presenting a trade-off for investors.In recent times, the Indian government has introduced significant changes in tax regulations, particularly concerning mutual funds. One of the most notable changes is the introduction of a new tax regime under Section 115BAC, which has sparked debates among investors about its implications on their financial plans.

Achieving Life Goals: The Role of the Old Tax Regim

Achieving Life Goals: The Role of the Old Tax Regime

While the new tax regime may offer certain advantages, the old tax regime shouldn’t be overlooked, especially concerning long-term financial planning. Here’s why:

The old tax regime allows for more significant deductions, enabling investors to channel funds towards essential life goals such as retirement planning, children’s education, and healthcare expenses.

With the flexibility to claim deductions under various sections, investors can optimize their tax liabilities while simultaneously working towards their financial aspirations.

The old tax regime still holds its ground as a viable option for investors aiming to achieve their life goals efficiently. While it may not offer the zero tax liability threshold for lower income brackets, it provides certain benefits that are worth considering. For instance, the availability of indexation benefits on long-term capital gains for debt mutual funds under the old regime can significantly reduce the tax burden on investors.

• When comparing the old and new tax regimes, it’s crucial to evaluate your unique financial situation and investment goals.

In conclusion, both the old and new tax regimes in India offer distinct advantages and considerations for investors in the mutual fund markets. While the new regime provides reduced tax rates, it comes with limitations on deductions, which may not suit everyone’s financial objectives. Ultimately, the choice between the two regimes depends on individual circumstances, goals, and tax planning strategies. It’s advisable to consult with a financial advisor to determine the most suitable approach tailored to your specific needs.

For more information and to understand how these tax regimes might affect your investment decisions, please visit the Income Tax official website and try their tax calculator.

https://incometaxindia.gov.in/pages/tools/tax-calculator.aspx

https://incometaxindia.gov.in/Pages/tools/115bac-tax-calculator-finance-act-2023.aspx

As your dedicated Certified financial-planner-gurgaon/" target="_blank" rel="nofollow">Financial Planner, it’s my privilege to provide you with comprehensive insights into the ever-evolving landscape of the Indian mutual fund market. Today, I am thrilled to delve into a critical topic that has been garnering significant attention among investors: the comparison between the old and new tax regimes.

Introduction: Understanding the Tax Dynamics

The Indian government’s recent amendments to tax regulations, particularly in the realm of mutual funds, have sparked a dialogue among investors regarding the optimal tax-saving strategies. The introduction of a new tax regime under Section 115BAC has introduced both opportunities and challenges for taxpayers, necessitating a thorough examination of its implications on investment portfolios.

Section 1: Unveiling the New Tax Regime

Under the new tax regime, individuals with a taxable income of up to Rs 5 lakh are entitled to zero tax liability, marking a notable departure from the previous tax structure. This provision offers relief to taxpayers in lower income brackets, presenting an attractive proposition for those seeking to minimize their tax burden.

Section 2: Impact of Finance Bill 2023 on Debt Mutual Funds

However, amidst the benefits of the new tax regime lies a significant change affecting debt mutual funds. The Finance Bill 2023 has eliminated indexation benefits on long-term capital gains for debt mutual funds, effective from April 1, 2023. Consequently, debt mutual funds are now subject to taxation at income tax rates based on an individual’s income, raising concerns among investors reliant on these funds for stable returns.

Section 3: The Legacy of the Old Tax Regime

In contrast to the new regime, the old tax regime retains its appeal as a viable option for investors striving to achieve their financial goals efficiently. While it may not offer zero tax liability for lower income brackets, it presents advantages that merit consideration. Notably, the availability of indexation benefits on long-term capital gains for debt mutual funds under the old regime serves as a significant tax-saving avenue for investors.

Section 4: Assessing Your Unique Financial Situation

When deliberating between the old and new tax regimes, it is imperative to conduct a personalized assessment of your financial circumstances and investment objectives. While the new regime offers tax relief for individuals with lower incomes, its suitability varies depending on individual risk profiles and investment preferences. Consider consulting with a financial advisor to evaluate the potential impact on your investment portfolio and devise tailored strategies to optimize tax efficiency while maximizing returns.

Conclusion: Making Informed Decisions

In conclusion, the choice between the old and new tax regimes in the Indian mutual fund market necessitates careful deliberation and a nuanced understanding of the associated benefits and drawbacks. As investors, it is crucial to remain vigilant in navigating these tax dynamics and aligning our financial plans with our long-term goals. Rest assured, your financial advisor is here to provide guidance and support every step of the way, ensuring that your investment decisions remain informed and aligned with your overarching financial objectives.

Here’s a summary of the key points:

Default Tax Regime and Opting for Old Regime:

◦ The new tax regime will be the default tax regime, but taxpayers have the option to choose the old regime if it’s more beneficial for them based on their financial situation.

• Tax Rebate and Exemption Limit:

◦ A tax rebate has been introduced under the new tax regime for incomes up to Rs. 7 lakhs, meaning taxpayers with taxable income below Rs. 7 lakhs will not have to pay any tax.

◦ The tax exemption limit has increased from Rs. 2.5 lakhs to Rs. 3 lakhs under the new tax regime.

• Tax Slabs:

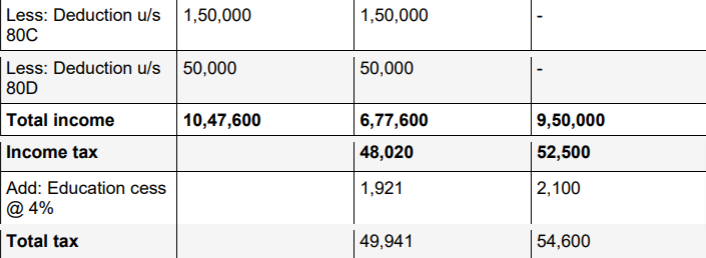

- The tax slabs have been recalibrated under the new tax regime as follows:

- Up to Rs. 3 lakhs: Nil

- Rs. 3 lakhs – Rs. 6 lakhs: 5%

- Rs. 6 lakhs – Rs. 9 lakhs: 10%

- Rs. 9 lakhs – Rs. 12 lakhs: 15%

- Rs. 12 lakhs – Rs. 15 lakhs: 20%

- Above Rs. 15 lakhs: 30%

Standard Deduction:

◦ The standard deduction of Rs. 50,000 has been extended to the new tax regime as well.

• Surcharge Rate:

◦ The highest surcharge rate has been reduced from 37% to 25% under the new tax regime for taxpayers earning more than Rs. 5 crore. This results in their overall tax rate decreasing from 42.74% to 39%.

• Exclusions and Deductions under New Tax Regime:

◦ Taxpayers opting for the new tax regime cannot claim several exemptions and deductions available under the old tax regime, such as HRA, LTA, 80C, 80D, etc.

◦ No deduction is allowed for self-occupied houses, including the interest paid on home loans.

• Optional Nature of New Tax Regime:

◦ Starting from FY 2020-21, individuals and HUFs have the option to choose the new tax regime, which offers lower tax rates and fewer deductions/exemptions.

These updates provide taxpayers with more flexibility and options in managing their tax liabilities. However, careful consideration is required to assess which regime is more advantageous based on individual circumstances and financial goals.

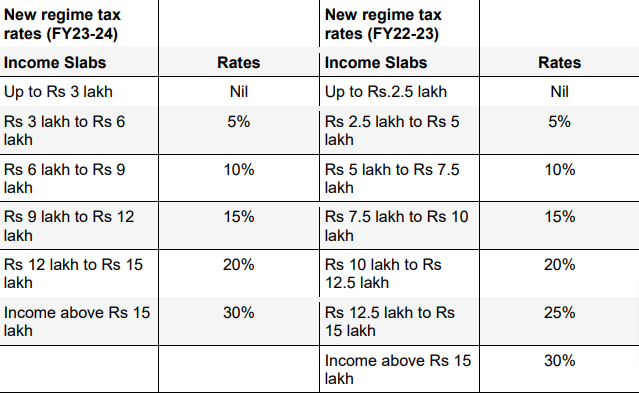

What are the tax rates under the new regime?

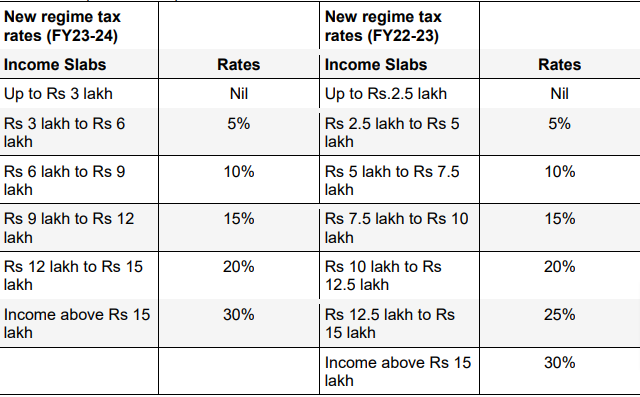

In Budget 2023, the income tax slabs under the new tax regime have been revised. The new tax slabs and tax rates under the new tax regime for FY 2023-24 (AY 2024-25) and FY 2022-23 (AY 2023-24) are shown in the table below:

Latest update: Budget 2023 changes under new tax regime

• New tax regime will be the default tax regime. However, taxpayers can opt for the old regime

• A tax rebate has been introduced under the new tax regime on income up to Rs.7 lakhs. Therefore, you do not have to pay tax if your taxable income is below Rs.7 lakhs under the new tax regime

• The tax exemption limit of Rs.2.5 lakh has increased to Rs.3 lakh under the new tax regime and tax slabs have been recalibrated under the new tax regime as follows:

Up to Rs.3 lakh: Nil

Rs.3 lakh-Rs.6 lakh: 5%

Rs.6 lakh-Rs.9 lakh: 10%

Rs.9 lakh-Rs.12 lakh: 15%

Rs.12 lakh-Rs.15 lakh: 20%

Above Rs.15 lakh: 30%

• The standard deduction of Rs 50,000 has been extended to the new tax regime as well

• The highest surcharge rate of 37% has been reduced to 25% under the new tax regime. This move impacts taxpayers earning more than Rs 5 crore. As a result, their overall tax rate will decrease from 42.74% to 39%

From FY 2020-21, you can choose to pay income tax under an optional new tax regime. The new tax regime is available for individuals and HUFs with lower tax rates and fewer deductions/exemptions. We will discuss the features of the new tax regime and how you can benefit from it.

What are the tax rates under the new regime?

In Budget 2023, the income tax slabs under the new tax regime have been revised. The new tax slabs and tax rates under the new tax regime for FY 2023-24 (AY 2024-25) and FY 2022-23 (AY 2023-24) are shown in the table below:

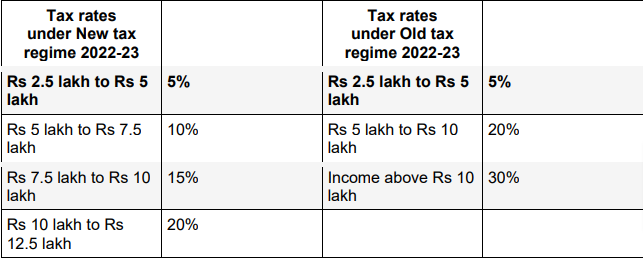

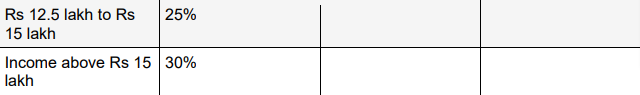

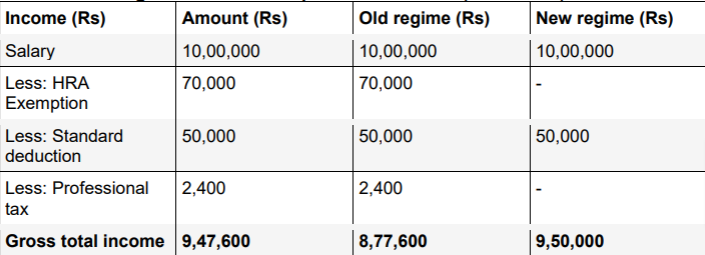

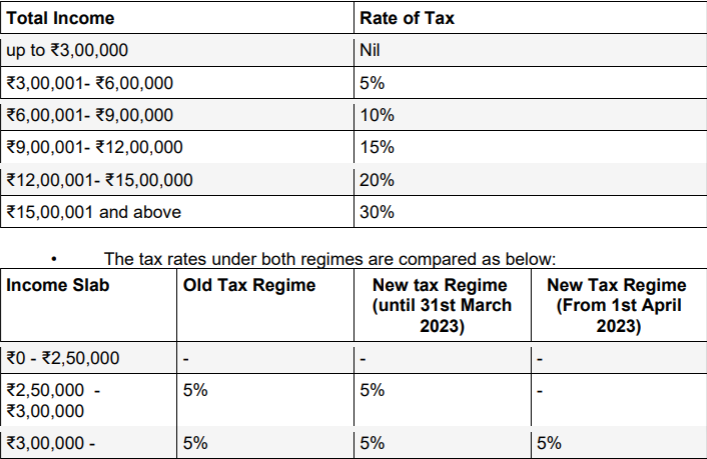

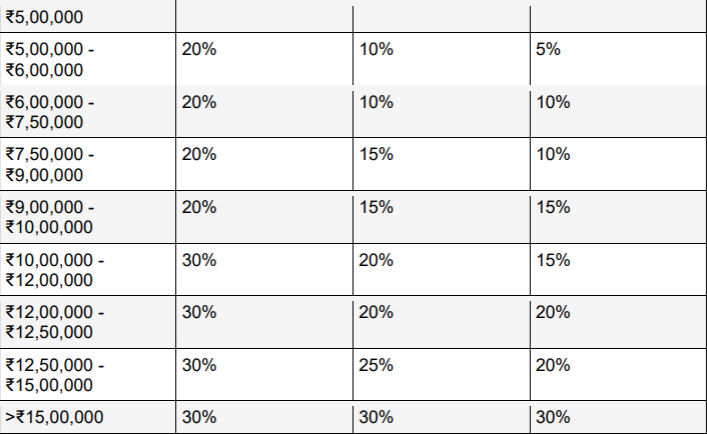

The tax rates under the new tax regime and the old tax regime for FY 2022-23 (AY 2023-24) are compared below:

– The new tax regime does not allow 70+ deductions and exemptions

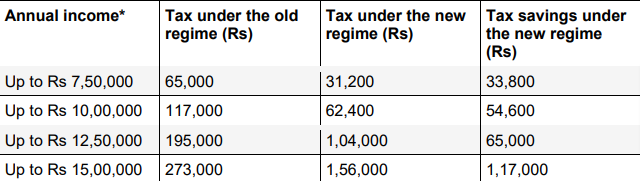

The tax payable under both the new and the old regimes without claiming deductions and exemptions for FY 2023-24 (AY 2024-25) is as below:

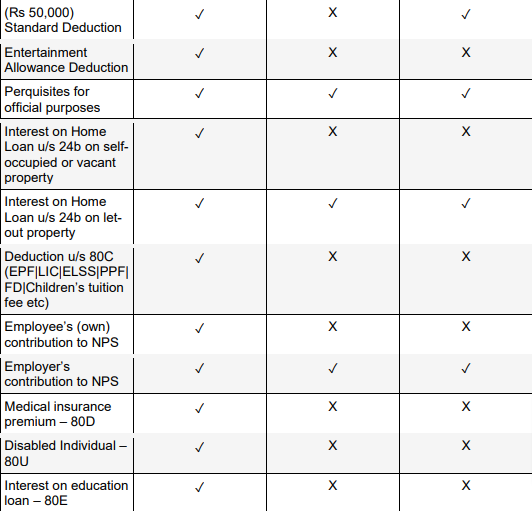

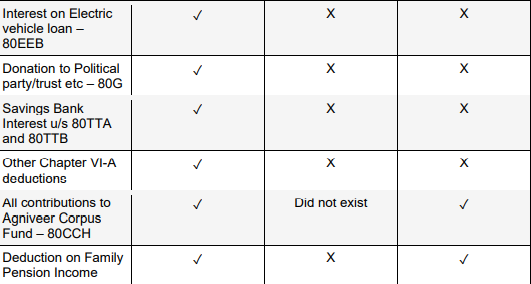

Exemptions and deductions not claimable under the new tax regime

- Under the new tax regime, several exemptions and deductions are not claimable, including:

- Standard deduction under Section 80TTA/80TTB

- Professional tax and entertainment allowance on salaries

- Leave Travel Allowance (LTA)

- House Rent Allowance (HRA)

- Minor child income allowance

- Helper allowance

- Children education allowance

- Other special allowances [Section 10(14)]

- Interest on housing loan on self-occupied property or vacant property (Section 24)

- Chapter VI-A deduction (Section 80C, 80D, 80E, etc., except Section 80CCD(2) and Section 80JJAA)

- Exemption or deduction for any other perquisites or allowances including food allowance of Rs 50/meal subject to 2 meals a day

- Employee’s (own) contribution to NPS

- Donation to Political party/trust, etc

- Deduction from family pension income up to FY 2022-23 (From FY 2023-24, it is allowed as deduction)

- Standard deduction of Rs. 50,000 up to FY 2022-23 (From FY 2023-24, it is allowed as deduction)

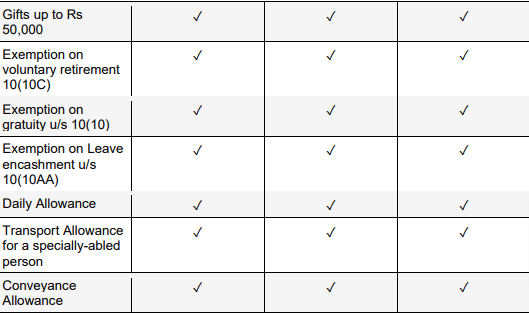

However, under the new tax regime, you can claim exemptions and deductions for:

- Transport allowances in case of a specially-abled person.

- Conveyance allowance received to meet the conveyance expenditure incurred as part of employment.

- Compensation received to meet the cost of travel on tour or transfer.

- Daily allowance received to meet ordinary regular charges or expenditure incurred due to absence from the regular place of duty.

- Perquisites for official purposes

- Exemption on voluntary retirement 10(10C), gratuity u/s 10(10), and Leave encashment u/s 10(10AA)

- Interest on Home Loan on let-out property (Section 24)

- Gifts up to Rs 50,000

- Deduction for employer’s contribution to NPS account [Section 80CCD(2)]

- Deduction for additional employee cost (Section 80JJA)

- Standard deduction of Rs 50,000 under New Tax Regime applicable from FY 2023-24

- Deduction under Section 57(iia) of family pension income

- Deduction of the amount paid or deposited in the Agniveer Corpus Fund under Section 80CCH(2)

Important Points to note if you select the new tax regime:

• Please note that the tax rates in the New tax regime are the same for all categories of Individuals, i.e. Individuals, Senior citizens, and Super senior citizens.

• Individuals with net taxable income less than or equal to Rs 7 lakh will be eligible for tax rebate u/s 87A, i.e. tax liability will be NIL under the new regime.

70 deductions & exemptions that are not allowed, out of which the most commonly used are listed below:

Comparison

Can I choose between the new tax regime and the existing regime?

A salaried taxpayer can choose the new tax regime at the beginning of FY 2023-24 and intimate their employer. The employee cannot change their choice anytime during the financial year. However, they can change their choice when filing the income tax return in July 2024.

The due date for tax filing for the FY 2023-24 (AY 2024-25) is 31st July 2024.

In case an employee does not choose the new tax regime at the beginning of the financial year, the employer will deduct tax (TDS) under the existing tax regime. A salaried taxpayer can choose the new tax regime in one year and choose the regular tax regime in another year.

For FY 2023-24, the default regime changed to the new tax regime, now if you want to file the return under the old tax regime by claiming all the deductions, exemptions, and losses, then you have to file within the due date.

Where the old regime is better in respect of tax outflow (FY 2023-24)

In Example above, for an income of Rs 10 lakh having HRA exemption and 80D deduction, the old tax regime is beneficial by Rs 4,659.

A new tax regime was introduced in Budget 2020 wherein the tax slabs were altered, and taxpayers were offer exemptions and deductions, such as HRA, LTA, 80C, 80D , and more. Because of this, the new tax regime did not have many takers. Government in the Budget 2023 introduced 5 key changes, which remain the same even for FY 2024-2025 since no changes were made in the Interim Budget 2024, to encourage taxpayers to adopt the new regime. They are:

Higher Tax Rebate Limit: Full tax rebate on an income up to ₹7 lakhs has been introduced. Whereas this threshold is ₹5 lakhs under the old tax regime. This means that taxpayers with an income of up to ₹7 lakhs will not have to pay any tax at all under the new tax regime!

Streamlined Tax Slabs: The tax exemption limit has been increased to ₹3 lakhs, and the new tax slabs are:

• Standard Deduction and Family Pension Deduction:

• Salary income:

The standard deduction of ₹50,000, which was only available under the old regime, has now been extended to the new tax regime as well. This, along with the rebate, makes ₹7.5 lakhs as your tax-free income under the new regime.

• Family pension:

Those receiving a family pension can claim a deduction of ₹15,000 or 1/3rd of the pension, whichever is lower.

• Reduced Surcharge for High Net Worth Individuals:

The surcharge rate on income over ₹5 crores has been reduced from 37% to 25%. This move will bring down their effective tax rate from 42.74% to 39%.

• Higher Leave Encashment Exemption:

The exemption limit for non-government employees has been raised from ₹3 lakhs to ₹25 lakhs, an 8-fold increase.

• Default Regime:

Starting from FY 2023-24, the new income tax regime will be set as the default option. If you want to continue using the old regime, you must submit the income tax return along with Form 10IEA before the due date. You will have the option to switch between the two regimes annually to check the tax benefits.

Q & A: Understanding the New Tax Regime

1. Can I choose between the new tax regime and the existing regime?

A: Yes, you can choose the new tax regime at the beginning of FY 2023-24 and intimate your employer. However, you cannot change your choice during the financial year. You can change your choice when filing the income tax return in July 2024.

2. What is Section 10 exemption in the new tax regime?

Section 10 provides exemptions for expenses incurred due to your employer’s business, including traveling, conveyance, research allowance, and more, provided such expenses are actually spent for the given purposes.

3. Which tax regime is better for an income of 25 lakhs?

Generally, the new regime is more beneficial unless you utilize deductions exceeding Rs 3.75 lakhs. Utilizing maximum deductions under 80C, 80D, etc., can bring your taxable income under the lower slabs in the old regime, leading to a lower tax burden.

4. Which tax regime is better for an income of 20 lakhs?

A: If your income is 20 lakhs, you should opt for the old tax regime as it provides more options for exemptions and deductions that you can claim to nullify your income tax liability.

5. Which tax regime is better for an income of 30 lakhs?

A: Individuals earning 30 lakhs are subject to income tax at a rate of 30% under the new regime. However, they have the option to pay tax at a lower rate of 25% on income between Rs. 30 lakhs and Rs. 2 crores, but they will have to forego most of the tax deductions and exemptions available under the old regime.

6. Can we claim PPF in the new tax regime?

No, under the new tax regime, deductions for investments in PPF are not allowed. Individuals opting for the new regime won’t be eligible to claim benefits such as deductions for investments in PPF.

7. Is NPS exempted under the new tax regime?

A: No, individuals under the new tax regime cannot claim deductions for NPS contributions. Only those who have opted for the old tax regime can apply for the additional deduction.

8. Which exemptions are allowed in the new tax regime?

A: Exemptions allowed in the new tax regime include transport allowances for Persons with Disabilities (PwD), conveyance allowance, travel/ tour/ transfer compensation, perquisites for official purposes, exemptions for Voluntary Retirement Scheme, gratuity amount, and leave encashment.

9. Is the new tax regime better than the old?

A: Generally, the new regime is more beneficial unless you utilize deductions exceeding Rs 3.75 lakhs. Utilizing maximum deductions under 80C, 80D, etc., can bring your taxable income under the lower slabs in the old regime, leading to a lower tax burden.

Summary: Understanding the Old and New Tax Regimes

Many individuals often grapple with the disparities between the old and new tax regimes. The new income tax regime caters to those with more personal commitments such as loan repayments, medical expenses for parents or dependents, or those seeking to streamline tax preparation without extensive deductions. On the other hand, the old tax regime may offer more tax savings for senior citizens, especially with provisions like Section 80TTB.

Both regimes have their pros and cons. The old tax structure encourages savings habits while the new one favors simplicity and lower deductions, potentially reducing the chance of tax evasion. However, individual circumstances dictate which regime is more suitable.

Based on the provided information, the current tax regime offers advantages for specific income levels. Individuals opting for fewer deductions, such as NPS investments or health insurance, find the new regime more beneficial, especially those earning between Rs. 5 lakh to Rs. 10 lakh annually. Conversely, higher-income earners, exceeding Rs. 15 lakh annually, may benefit from the existing regime by utilizing tax-saving investments.

In conclusion, a thorough comparison of both regimes is necessary to determine the best fit for each individual, considering their income, deductions, and personal financial goals.

The author of this article is Taresh Bhatia, a Financial Freedom Specialist, qualified as a CERTIFIED FINANCIAL PLANNER PRO who has authored an Amazon best seller-“The Richness Principles”. He can be reached at taresh@tareshbhatia.com

©️2024: All Rights Reserved. Taresh Bhatia

Subscribe Now for Upcoming Blogs!

📢 Join free live webinar —

Couple Finance Formula™ Register here